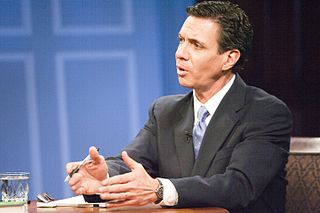

A Quote by Alex Berenson

In a Ponzi scheme, a promoter pays back his initial investors with money he has raised from new investors. Eventually, the promoter can no longer find enough new investors to pay off the people who have already put up money, and the scheme collapses.

Related Quotes

When running a Ponzi scheme, how does one avoid enormous, unexpected withdrawals - runs on the bank, so to speak - that would pull back the curtain and reveal a little man blowing smoke? One way would be to attract a core of investors who could be counted on to never withdraw more than a small percentage of principal each year.

A pin lies in wait for every bubble. And when the two eventually meet, a new wave of investors learns some very old lessons: First, many in Wall Street (a community in which quality control is not prized) will sell investors anything they will buy. Second, speculation is most dangerous when it looks easiest.

Where you want to be is always in control, never wishing, always trading, and always first and foremost protecting your ass. That's why most people lose money as individual investors or traders because they're not focusing on losing money. They need to focus on the money that they have at risk and how much capital is at risk in any single investment they have. If everyone spent 90 percent of their time on that, not 90 percent of the time on pie-in-the-sky ideas on how much money they're going to make, then they will be incredibly successful investors.

The government has brought on the housing problem, partly by these very low interest rates, which encouraged many people to go way out on a limb. They've brought it on by highly restrictive building policies, which have caused housing prices to skyrocket artificially. And they've brought it on by the Community Reinvestment Act, which presumes that politicians are better able to tell investors where to put their money than the investors themselves are. When you put all that together, you get something like what you have.

Too often, investors are the target of fraudulent schemes disguised as investment opportunities. As you know, if the balance is tipped to the point where investors are not confident that there are appropriate protections, investors will lose confidence in our markets, and capital formation will ultimately be made more difficult and expensive.

I want to open up investment even further so over the summer we'll launch a consultation on indirect investments in social enterprises - including exploring the possibility of a new scheme based on the success of venture capital trusts which will enable investors to pool their funds to support a variety of social enterprises.