A Quote by Alex Berenson

The details of the personal expenses that executives put on the company tab often are not known because loopholes in federal disclosure rules let publicly traded companies generally avoid disclosing the perks they give executives along with pay and stock options.

Related Quotes

The great problem with corporate capitalism is that publicly owned companies have short time horizons. Unlike a privately owned business, the top executives of a publicly owned corporation generally come to their positions late in life. Consequently, they have a few years in which to make their fortune.

When top executives get huge pay hikes at the same time as middle-level and hourly workers lose their jobs and retirement savings, or have to accept negligible pay raises and cuts in health and pension benefits, company morale plummets. I hear it all the time from employees: This company, they say, is being run only for the benefit of the people at the top. So why should we put in extra effort, commit extra hours, take on extra responsibilities? We'll do the minimum, even cut corners. This is often the death knell of a company.

These pharmaceutical company executives are dope dealers and they should be treated worse, and more roughly than dope dealers. When you're talking about millionaire and billionaire executives at pharmaceutical companies, these are people with something to lose if threatened with jail. Frog-march them out of their door in suburbia, handcuffed and surrounded by DEA officers, with their children and neighbours watching.

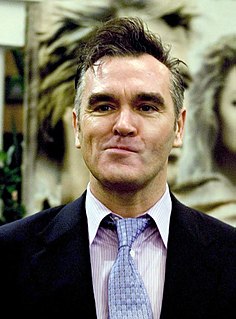

Obviously, it's designed by record company executives who want a cheap success, and they don't want to give money to anybody and they don't want to give contracts, so they've created this world of very bubbly teenagers who want to be "idols" and they think all they have to do is mime quite well and they've made it. ... But it's not the problem of the kids, it's the problem of the record companies, because it's just an inexpensive way for them to have so-called, I won't say "artists", but erm...You're nodding, you know what I mean.

The British use a system where the profits a corporation reports to shareholders is what they pay taxes on. Whereas in America we require corporations to keep two sets of books, one for shareholders and one for the IRS, and the IRS records are secret. For publicly-traded companies, the British system would tend to align the interests of the government with the interests of the company because the company wants to report the biggest possible profit. Though, all wealthy countries have high taxes as wealth requires lots of common goods, from clean water to public education to a justice system.

Senior executives can, after a fashion, get a portion of their pay tax-free. You defer part of your income and not have to pay taxes on it, and then when you retire you have the company buy a life insurance policy on you using that money. The company can deduct that money because it is a business expense, and the money will get paid out to your children or grandchildren when you die, so you have effectively given them your money and it's never been taxed.