A Quote by Alexander Hamilton

It is a well-known fact that in countries in which the national debt is properly funded, and an object of established confidence, it answers most of the purposes of money. Transfers of stock, or public debt, are there equivalent to payments in specie; or, in other words, stock, in the principal transactions of business, passes current as specie. The same thing would, in all probability, happen here, under the like circumstances.

Quote Topics

Answers

Business

Circumstances

Confidence

Countries

Current

Debt

Equivalent

Established

Fact

Happen

In Other Words

Known

Like

Money

Most

National

National Debt

Object

Other

Passes

Payments

Principal

Probability

Properly

Public

Purposes

Same

Same Thing

Stock

Thing

Transactions

Transfers

Well

Which

Words

Would

Related Quotes

The burden of the national debt consists not in its being so many millions, or so many hundred millions, but in the quantity of taxes collected every year to pay the interest. If this quantity continue the same, the burden of the national debt is the same to all intents and purposes, be the capital more or less.

Debt is so ingrained into our culture that most Americans can't even envision a car without a payment ... a house without a mortgage ... a student without a loan ... and credit without a card. We've been sold debt with such repetition and with such fervor that most folks can't conceive of what it would be like to have NO payments.

Shipping first time code is like going into debt. A little debt speeds development so long as it is paid back promptly with a rewrite. The danger occurs when the debt is not repaid. Every minute spent on not-quite-right code counts as interest on that debt. Entire engineering organizations can be brought to a standstill under the debt load of an unconsolidated implementation, object-oriented or otherwise.

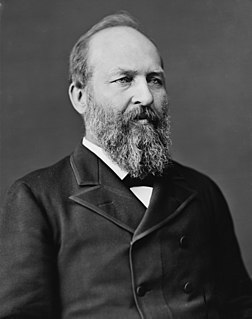

The prosperity which now prevails is without parallel in our history. Fruitful seasons have done much to secure it, but they have not done all. The preservation of the public credit and the resumption of specie payments, so successfully attained by the Administration of my predecessors, have enabled our people to secure the blessings which the seasons brought.

Debt is a trap, especially student debt, which is enormous, far larger than credit card debt. It’s a trap for the rest of your life because the laws are designed so that you can’t get out of it. If a business, say, gets in too much debt it can declare bankruptcy, but individuals can almost never be relieved of student debt through bankruptcy.

Debt is a trap, especially student debt, which is enormous, far larger than credit card debt. It's a trap for the rest of your life because the laws are designed so that you can't get out of it. If a business, say, gets in too much debt, it can declare bankruptcy, but individuals can almost never be relieved of student debt through bankruptcy.

This debt crisis coming to our country. The wall and tidal wave of debt that is befalling our nation. Medicare and Social Security go bankrupt within ten years, we have a debt that is looming so high that in the last year of President Obama's budget just the interest payments on our debt is $916 billion dollars.

I am for a government rigorously frugal & simple, applying all the possible savings of the public revenue to the discharge of the national debt; and not for a multiplication of officers & salaries merely to make partisans, & for increasing, by every device, the public debt, on the principle of its being a public blessing.