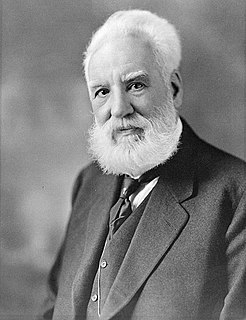

A Quote by Amar Bose

One hundred percent of our earnings are reinvested in the company, and a great deal of that goes to research.

Related Quotes

When you're in a start-up, the first ten people will determine whether the company succeeds or not. Each is 10 percent of the company. So why wouldn't you take as much time as necessary to find all the A players? If three were not so great, why would you want a company where 30 percent of your people are not so great? A small company depends on great people much more than a big company does.

If you look at the expenses of a great pharmaceutical company, they pay between about 10 to 15 percent of their expenses for research, but they use 30 to 40 percent of their incomes for marketing and promotion. It is not completely wrong that they spend so much, but it is not correct to say that there is a direct connection between the price of drugs and the cost of research. It could be more between the cost of marketing and the cost of the drugs.

The Hispanic population grew by 4.7 percent last year, while blacks expanded by 1.5 percent and whites by a paltry 0.3 percent. Hispanics cast 6 percent of the vote in 1990 and 12 percent in 2000. If their numbers expand at the current pace, they will be up to 18 percent in 2010 and 24 percent in 2020. With one-third of Hispanics voting Republican, they are the jump ball in American politics. As this vote goes, so goes the future.

Being captive to quarterly earnings isn't consistent with long-term value creation. This pressure and the short term focus of equity markets make it difficult for a public company to invest for long-term success, and tend to force company leaders to sacrifice long-term results to protect current earnings.

I'm thinking, That's Barack Obama. He doesn't go to work. He doesn't go down to Congress and make a deal. What the hell's he doing sitting in the White House? If I were in that job, I'd get down there and make a deal. Sure, Congress are lazy bastards, but so what? You're the top guy. You're the president of the company. It's your responsibility to make sure everybody does well. It's the same with every company in this country, whether it's a two-man company or a two-hundred-man company... . And that's the pussy generation - nobody wants to work.

The best CEOs in our research display tremendous ambition for their company combined with the stoic will to do whatever it takes, no matter how brutal (within the bounds of the company's core values), to make the company great. Yet at the same time they display a remarkable humility about themselves, ascribing much of their own success to luck, discipline and preparation rather than personal genius.