A Quote by Andrea Leadsom

If the government has any courage, it will punish those at the top of failed banks. Accountability is critical in every area of human endeavour - there has to be a penalty for failure; otherwise, it's only a matter of time before the economic pain our banks have caused to so many innocent businesses and homeowners is forgotten.

Related Quotes

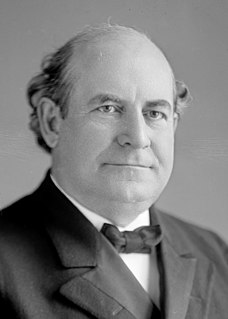

We [US government] have used our taxpayer dollars not only to subsidize these banks but also to subsidize the creditors of those banks and the equity holders in those banks. We could have talked about forcing those investors to take some serious hits on their risky dealings. The idea that taxpayer dollars go in first rather than last - after the equity has been used up - is shocking.

In our election manifesto is: we keep the right to create money and to bring in circulation, for the cause of the government ... Those who do not share this view, reply us to the issue of paper money is for the banks, the government should stay out of the banking business. I agree with Jefferson's opinion ... and just like him I say again: the issue of money is a matter for the government and the banks should stay out of government activity.

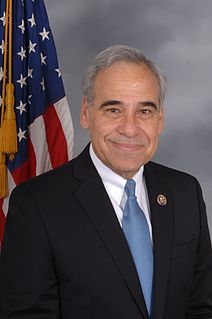

One nation banking recognises that banks must not be isolated from the rest of the economy. Because banks and small businesses must succeed or fail together, banks must lend to small businesses so we can get the growth and jobs we need for the future. As things stand, that is not happening enough. Lending was down £10.8billion last year.

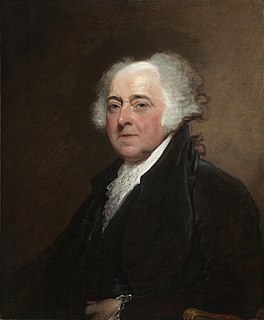

Our whole system of banks is a violation of every honest principle of banks. There is no honest bank but a bank of deposit. A bank that issues paper at interest is a pickpocket or a robber. But the delusion will have its course. ... An aristocracy is growing out of them that will be as fatal as the feudal barons if unchecked in time.