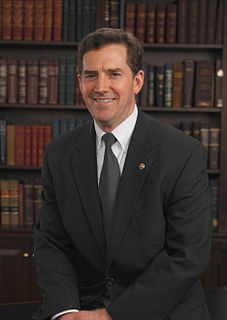

A Quote by Andrew Adonis, Baron Adonis

Multinational companies exploit national differences to abuse their workers, to dodge their taxes and to 'regulation shop' as a means to avoid meeting their responsibilities.

Related Quotes

Some favorite expressions of small children: "It's not my fault...They made me do it...I forgot." Some favorite expressions of adults: "It's not my job...No one told me...It couldn't be helped." True freedom begins and ends with personal accountability. -Dan Zadra It is easy to dodge our responsibilities, but we cannot dodge the consequences of dodging our responsibilities.

By the standards of honest, if unorthodox, accounting, government workers don't pay taxes, but are paid out of taxes. In other words, they pay taxes out of money confiscated from taxpayers, who, in turn, pay taxes twice: on their own income and on the income of members of the bureaucracy. At the very least, this should disqualify state workers from voting.

The EU treaties clearly promote an alliance of national states that, as far as possible, maintain their own responsibilities. There is no mention of a centralized state of Europe in the treaties. The EU Commission's politicking, however, is proof of a certain allergy against this principle of national states and national responsibilities.

The competitive pressure to produce, buy, and sell to our global multi-national companies is so intense that contractors in supply chains are motivated to pay low wages, intensify exploitative conditions, keep workers fearful with insecure work contracts, or simply sack workers who have formed a union to fight back.