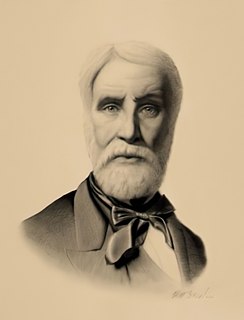

A Quote by Andrew Forrest

We really need to change taxation policy so that it is not skewed against owning more than one house.

Related Quotes

One strategy that the tea party smartly embraced was one of being almost entirely defensive. They consciously decided not to figure out which of their really abominable conservative policy priorities to prioritize. Instead, anything that came out of the Obama White House they were against. What they recognized is that when you've lost the White House and the House of Representatives and the Senate, you're not setting the agenda anymore. We progressives find ourselves in a similar situation now.

The real difficulty is with the vast wealth and power in the hands of the few and the unscrupulous who represent or control capital. Hundreds of laws of Congress and the state legislatures are in the interest of these men and against the interests of workingmen. These need to be exposed and repealed. All laws on corporations, on taxation, on trusts, wills, descent, and the like, need examination and extensive change. This is a government of the people, by the people, and for the people no longer. It is a government of corporations, by corporations, and for corporations.

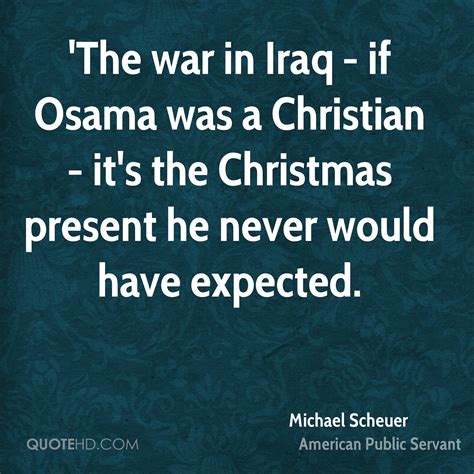

So what we have is an American foreign policy that is inextricably linked to domestic matters. It is very dangerous for a politician who desires nothing more than to stay in office to address the mindset that any change in policy is appeasement. And Americans will accept that for a certain amount of time.

Contrary to any claim of a systematically “neutral” effect of taxation on production, the consequence of any such shortening of roundabout methods of production is a lower output produced. The price that invariably must be paid for taxation, and for every increase in taxation, is a coercively lowered productivity that in turn reduces the standard of living in terms of valuable assets provided for future consumption. Every act of taxation necessarily exerts a push away from more highly capitalized, more productive production processes in the direction of a hand-to-mouth-existence.