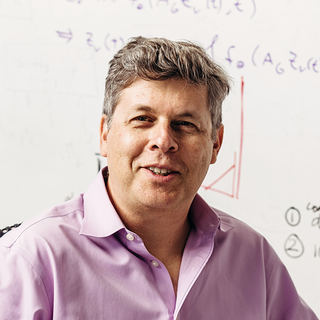

A Quote by Andrew Forrest

Tax can be structured in a way that actually encourages investment in infrastructure and encourages investment in Australia from overseas.

Quote Topics

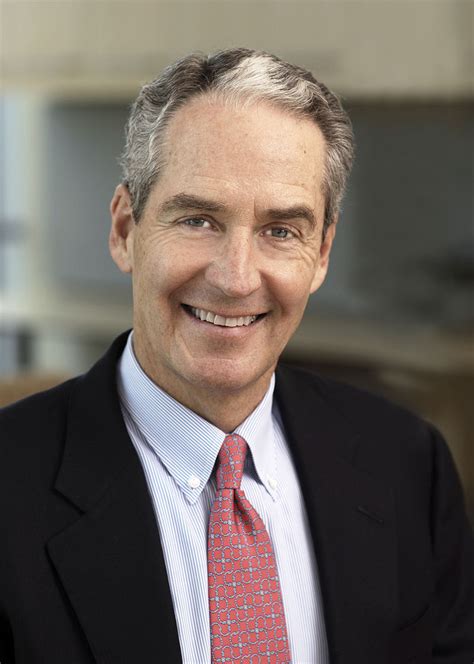

Related Quotes

Too many politicians seem to reach for 'infrastructure' as the default answer to investment, as if roads and bridges were the answer to everything. Even the IMF and the World Bank seem to mainly offer infrastructure spending as an alternative to austerity, although they are right to focus on the need for investment.

There's a long list of investments that governments could and should be making. There is strengthening infrastructure, such as transport and communications; there is investment in education; there is investment in families, particularly putting measures in place that free women from having to make the choice between raising a family and work.