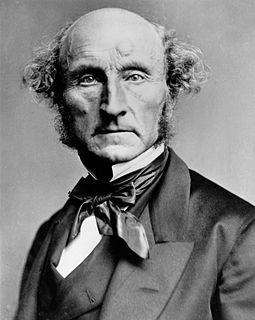

A Quote by Andrew Lo

The adaptive markets hypothesis says that all economic institutions, like our own species, develop and change over time, depending on the population of investors that are engaged with them.

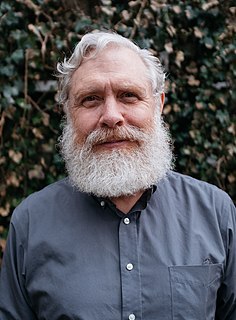

Related Quotes

Markets are a social construction, they're made from institutions. We in a democratic society create markets, we constitute markets, we bring them into existence, and we shouldn't turn markets over to a narrow group of people who regulate them and run them in their interests, rather they should be run democratically for the common good.

...we sacrifice other species to our own not because our own has any objective metaphysical privilege over others, but simply because it is ours. It may be very natural to have this loyalty to our own species, but let us hear no more from the naturalists about the "sentimentality" of anti-vivisectionists. If loyalty to our own species - preference for man simply because we are men - is not sentiment, then what is?

History shows that great economic and social forces flow like a tide over communities only half conscious of that which is befalling them. Wise statesmen foresee what time is thus bringing, and try to shape institutions and mold men's thoughts and purposes in accordance with the change that is silently coming on. The unwise are those who bring nothing constructive to the process, and who greatly imperil the future of mankind by leaving great questions to be fought out between ignorant change on one hand and ignorant opposition to change on the other.

Part of my advantage is that my strength is economic forecasting, but that only works in free markets, when markets are smarter than people. That's how I started. I watched the stock market, how equities reacted to change in levels of economic activity, and I could understand how price signals worked and how to forecast them.

The international institutions go around the world preaching liberalization, and the developing countries see that means open up your markets to our commodities, but we aren't going to open our markets to your commodities. In the nineteenth century, they used gunboats. Now they use economic weapons and arm-twisting.

I was thinking about that. I was thinking, this is like our Boyhood; this is like our getting together over 12 years to make - this our Apehood! I mean, this is it! For me, the relationships, all of those things, over such a long period of time now with actors, but also seeing the characters grow, develop, and change, and go through different situations.

Does character develop over time? In novels, of course it does: otherwise there wouldn't be much of a story. But in life? I sometimes wonder. Our attitudes and opinions change, we develop new habits and eccentricities; but that's something different, more like decoration. Perhaps character resembles intelligence, except that character peaks a little later: between twenty and thirty, say. And after that, we're just stuck with what we've got. We're on our own. If so, that would explain a lot of lives, wouldn't it? And also - if this isn't too grand a word - our tragedy.

We need to reorganize our entire system of retirement plan investing and to develop federal standards of fiduciary duty for pension trustees and fund managers. These require "top down" intervention. But we also need investors to look after their own economic interests, a bottom up approach to our problems that is well within our individual power to undertake.

I believe that the behavior of too many of our corporations investment bankers and fund managers has jeopardized some of the trust that investors have had. It's not the economic engine that we need to focus on, but the need to make sure that our investors receive their fair share of the returns that that great economic system produces.

Too often, investors are the target of fraudulent schemes disguised as investment opportunities. As you know, if the balance is tipped to the point where investors are not confident that there are appropriate protections, investors will lose confidence in our markets, and capital formation will ultimately be made more difficult and expensive.

Clearly, we are a species that is well connected to other species. Whether or not we evolve from them, we are certainly very closely related to them. A series of mutations could change us into all kinds of intermediate species. Whether or not those intermediate species are provably in the past, they could easily be in our future.

Our [Afghanistan] main problem is education. Over 90 percent of our population is uneducated. So what can you expect? The terrorists come from Syria, Iraq, Pakistan, saying the Quran says this, Quran says that, and the Afghans believe that because they speak Arabic, they think they know the language of Quran, and they know Islam better than us, let's follow them. So they simply follow them.