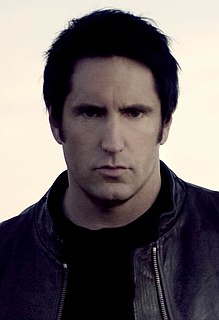

A Quote by Andrew Lo

During periods of extreme fear or greed, you don't have the proper balance between those two to generate market efficiency and you get extremes in behavior.

Related Quotes

Basically, for any complex to be sustainable needs to have a balance between two factors: resilience and efficiency. These two factors can be calculated from the structure of the network that is involved in a complex system. A resilient, efficient system needs to be diverse and interconnected. On the other hand, diversity and interconnectivity decrease efficiency. Therefore, the key is an appropriate balance between efficiency and resilience.

But in the financial markets, without proper institutional rules, there's the law of the jungle - because there's greed! There's nothing wrong with greed, per se. It's not that people are more greedy now than they were 20 years ago. But greed has to be tempered, first, by fear of losses. So if you bail people out, there's less fear. And second, b prudential regulation and supervision to avoid certain excesses.

My position is that the rate should align with the level of economic development. Because it is always about a balance, a balance of interests, and it should reflect this balance. A balance between those who sell something across the border and those who benefit from a low rate, as well as a balance between the interests of those who buy, who need the rate to be higher. A balance between national producers, for example, agricultural producers who are interested in it.

Just as outright euphoria is often a sign of a market top, fear is for sure a sign of a market bottom. Time and time again, in every market cycle I have witnessed, the extremes of emotion always appear, even among experienced investors. When the world wants to buy only treasury bills, you can almost close your eys and get long stocks.

Dharma gives you the balance. It gives you the establishment into proper behavior, proper understanding, proper living, but it doesn't give you the completion of your journey. It doesn't give you the satisfaction of reaching the destination and your personality is still incomplete. So one has to have the experience of the spirit.

The true secret of natural goodness lies in the recognition of the contending rights of the Pairs of Opposites; there is no such antimony as between Good and Evil, but only balance between two extremes, each of which is evil when carried to excess, both of which give rise to evil if insufficient for equipoise.

The latest trade of a security creates a dangerous illusion that its market price approximates its true value. This mirage is especially dangerous during periods of market exuberance. The concept of "private market value" as an anchor to the proper valuation of a business can also be greatly skewed during ebullient times and should always be considered with a healthy degree of skepticism.