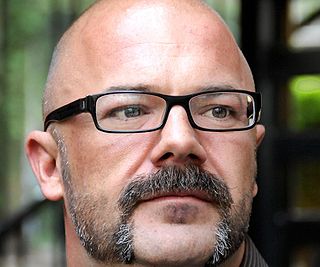

A Quote by Andrew Lo

More and more investors may be coming into markets everywhere but that doesn't mean that the markets are really getting more and more efficient, even in the United States. It does mean that there is more access for savvy investors who watch the money flows.

Related Quotes

Too often, investors are the target of fraudulent schemes disguised as investment opportunities. As you know, if the balance is tipped to the point where investors are not confident that there are appropriate protections, investors will lose confidence in our markets, and capital formation will ultimately be made more difficult and expensive.