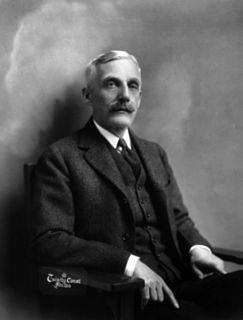

A Quote by Andrew Mellon

The history of taxation shows that taxes which are inherently excessive are not paid. The high rates inevitably put pressure upon the taxpayer to withdraw his capital from productive business.

Related Quotes

The history of taxation shows that taxes which are inherently excessive are not paid. The high rates inevitably put pressure upon the taxpayer to withdraw his capital from productive business and invest it in tax-exempt securities or to find other lawful methods of avoiding the realization of taxable income. The result is that the sources of taxation are drying up; wealth is failing to carry its share of the tax burden; and capital is being diverted into channels which yield neither revenue to the Government nor profit to the people.

Buying a share of a good business is better than buying a share of a bad business. One way to do this is to purchase a business that can invest its own money at high rates of return rather than purchasing a business that can only invest at lower ones. In other words, businesses that earn a high return on capital are better than businesses that earn a low return on capital.

You could not possibly maintain the current level of government taxation without the taxes being hidden, and they are hidden in two very different ways. They are hidden through withholding, but they are also hidden by being imposed on business, supposedly on business, when really, of course, business can't pay taxes, only people can pay taxes.

Arthur Laffer's idea, that lowering taxes could increase revenues, was logically correct. If tax rates are high enough, then people will go to such lengths to avoid them that cutting taxes can increase revenues. What he was wrong about was in thinking that income tax rates were already so high in the 1970s that cutting them would raise revenues.

Contrary to any claim of a systematically “neutral” effect of taxation on production, the consequence of any such shortening of roundabout methods of production is a lower output produced. The price that invariably must be paid for taxation, and for every increase in taxation, is a coercively lowered productivity that in turn reduces the standard of living in terms of valuable assets provided for future consumption. Every act of taxation necessarily exerts a push away from more highly capitalized, more productive production processes in the direction of a hand-to-mouth-existence.

We're guessing at our future opportunity cost. Warrenis guessing that he'll have the opportunity to put capital out at high rates of return, so he's not willing to put it out at less than 10% now. But if we knew interest rates would stay at 1%, we'd change. Our hurdles reflect our estimate of future opportunity costs.

Texas has no income tax, which is a big draw for corporate executives who do business there. But it's hardly tax-free. The property taxes are high for a Southern state. The sales taxes are high. One study found that the bottom 20 percent of the Texas population pays 12 percent of its income in state and local taxes.

Regarding the Economy & Taxation: America's most successful achievers do pay a higher share of the total tax burden. The top one percent income earners paid 18 percent of the total tax burden in 1981, and paid 25 percent in 1991. The bottom 50 percent of income earners paid only 8 percent of the total tax burden, and paid only 5 percent in 1991. History shows that tax cuts have always resulted in improved economic growth producing more tax revenue in the treasury.