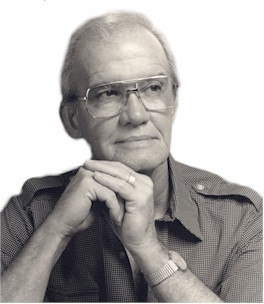

A Quote by Andrew Ross Sorkin

When you can't lend or trade - and you can't invest with the leverage that juiced returns to support seven- and eight-figure bonuses - how exactly are you going to make money?

Related Quotes

When I talk about how we're going to pay for education, how we're going to invest in infrastructure, how we're going to get the cost of prescription drugs down, and a lot of the other issues that people talk to me about all the time, I've made it very clear we are going where the money is. We are going to ask the wealthy and corporations to pay their fair share.

One of the tax systems in the US is for wage earners. The government takes money from them out of each paycheck - so it knows how much they make, and those workers can't cheat to any significant degree. But the other tax system is for capital. Those with capital get to tell the government what they want to tell. They may get audited, but if their tax returns are of any size the government doesn't have enough of the smart auditors to figure out what's really going on. And there are the rules that allow you to do things like take in money today and pay taxes on it thirty years from now.