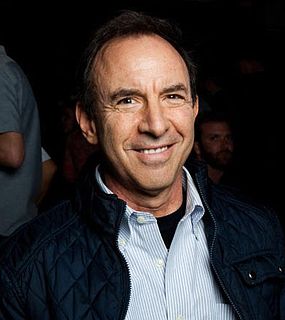

A Quote by Andrew Tobias

There were no jobs created in America from 1945, when the war ended, through 2003. How could there be? Taxes were too high. Preposterously so under Eisenhower, Kennedy, Nixon, Reagan (who left office with a 28 percent rate on long-term capital gains) and Bush the Elder.

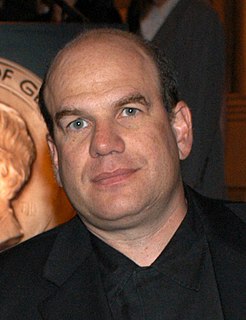

Related Quotes

My tax plan will cut taxes for 95 percent of workers, because we need to put money back into the pockets of struggling middle-class families and close the egregious tax loopholes that have exploded over the last eight years. My plan eliminates capital gains taxes entirely for the small businesses and start-ups that are the backbone of our economy, as opposed to John McCain's plan, which would tax these businesses. John McCain is running to serve out a third Bush term. But the truth is, when it comes to taxes, that's not being fair to George Bush.

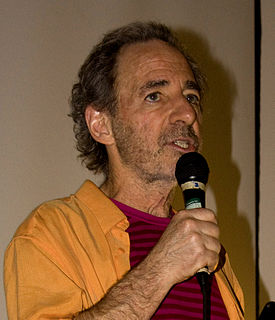

I'm making a lot of money. I should be paying a lot more taxes. I'm not paying taxes at a rate that is even close to what people were paying under Eisenhower. Do people think America wasn't ascendant and wasn't an upwardly mobile society under Eisenhower in the '50s? Nobody was looking at the country then and thinking to themselves, "We're taxing ourselves into oblivion." Yet there isn't a politician with balls enough to tell that truth because the whole system has been muddied by the rich. It's been purchased.

I couldn't help but be struck that this guy I had thought was the embodiment of everything wrong with American politics, a lot of his domestic policy was mind-numbingly, head-spinningly to the left of Obama's. It was under Nixon that the EPA was created. It was under Nixon that OSHA was created. Under Nixon that the Clean Air and Clean Water Acts were passed.

I remember when President Bush, George W. Bush, came into office, he focused on No Child Left Behind, and with - and before very long, suddenly, Republicans were thought of as being as interested and as competent in education as Democrats, and why? Because they were talking about it and doing something about it.