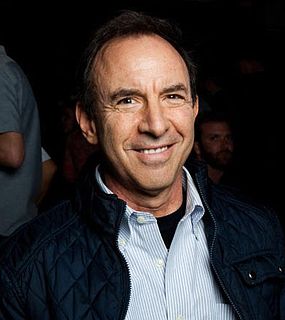

A Quote by Andrew Tobias

The first American insurance company was the Friendly Society for the Mutual Insurance of Houses Against Fire, founded in Charles Town in South Carolina, in 1735.

Related Quotes

The first life insurance societies where formed in England in the years between 1692 and 1720. In America, life insurance became available to the clergy through the Presbyterian Ministers Fund, founded in 1759 (still in existence), and the Episcopal Corporation, founded ten years later (subsequently merged).

While Free Choice Vouchers didn't fulfill my vision of a health care system in which every American would be empowered to hire and fire their insurance company, they were a foothold for choice and competition and a safety valve for Americans whose employers are already forcing them to bear more and more of their family's health insurance costs.

Health insurance, which is exceedingly difficult to secure as an individual in New York. Obamacare, while certainly better than nothing, is pretty awful, and if you have a complicated health history, as I do, you need premium insurance, which means private insurance. The challenge, though, is finding a company that will give you the privilege of paying up to $1,400 a month for it. When I didn't have a job, I spent more time thinking about insurance - not just paying for it, but securing it in the first place - than I wanted to.

I have dear friends in South Carolina, folks who made my life there wonderful and meaningful. Two of my children were born there. South Carolina's governor awarded me the highest award for the arts in the state. I was inducted into the South Carolina Academy of Authors. I have lived and worked among the folks in Sumter, South Carolina, for so many years. South Carolina has been home, and to be honest, it was easier for me to define myself as a South Carolinian than even as an American.

The premise of insurance is to spread the risk. It's the premise of homeowner's insurance, of car insurance, and of health insurance. It's one reason why it's important to have insurance when you're healthy, so that when you get sick, you won't go sign up just when you get sick, because that increases the cost for everyone.

Well, I'm telling them two things. One is that, look, this is going to be something when the American people realize - once it's passed - that, A, it does take care of preexisting conditions; B, you're insurance rates aren't going to skyrocket; C, the insurance companies aren't going to be running the show like they were before; D, you're going to be in a position where you can keep your insurance that you have. That once the American public realizes that, you're going to get a reward for this. They're going to be rewarded.

Advertising is the best insurance that you can take out on your business. You can buy fire insurance on your stock of goods, but no company will issue a policy covering your business, the good will as they sometimes call it. You must insure yourself, and the best way to do it is by advertising. Good advertising kept up for a number of years gives you something that no fire can take away.

How do commercial interests usually protect themselves from liability claims? Through insurance. In fact, in our society, the litmus test for safety is insurance. You can be insured for almost anything if you pay enough for the premium, but if the insurance industry isn't willing to bet its money on the safety of [biotechnology], it means the risks are simply too high or too uncertain for them to take the gamble.