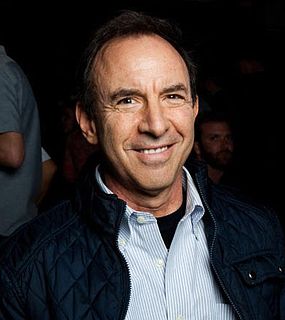

A Quote by Andrew Tobias

In short: Readily available low-cost life insurance would be a threat to the industry, and whatever threatens the life insurance industry threatens America.

Related Quotes

We can all instinctively understand the idea of life insurance; most of us will feel an instinctive repugnance at the thought of the viatical industry, or 'dead peasants insurance.' As market thinking penetrated the life insurance industry, a moral line was crossed, and the application of market ideas was taken too far.

The first life insurance societies where formed in England in the years between 1692 and 1720. In America, life insurance became available to the clergy through the Presbyterian Ministers Fund, founded in 1759 (still in existence), and the Episcopal Corporation, founded ten years later (subsequently merged).

The premise of insurance is to spread the risk. It's the premise of homeowner's insurance, of car insurance, and of health insurance. It's one reason why it's important to have insurance when you're healthy, so that when you get sick, you won't go sign up just when you get sick, because that increases the cost for everyone.

How do commercial interests usually protect themselves from liability claims? Through insurance. In fact, in our society, the litmus test for safety is insurance. You can be insured for almost anything if you pay enough for the premium, but if the insurance industry isn't willing to bet its money on the safety of [biotechnology], it means the risks are simply too high or too uncertain for them to take the gamble.

The best tool today is longevity insurance - they call it income insurance. Most people know the value of life insurance. But what if you live? So instead of trying to guess one or the other, you plan for those 20 years and you get this income insurance. If you live beyond 85, you have money that's guaranteed for as long as you live in the form of an annuity.