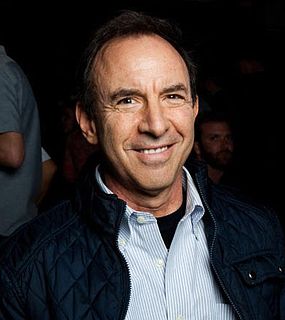

A Quote by Andrew Tobias

The larger the deductible you choose, the less insurance you are buying. Insurers want to sell insurance.

Related Quotes

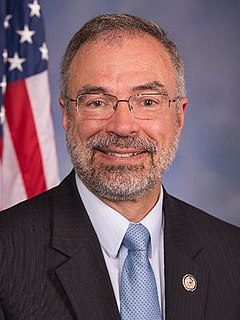

The premise of insurance is to spread the risk. It's the premise of homeowner's insurance, of car insurance, and of health insurance. It's one reason why it's important to have insurance when you're healthy, so that when you get sick, you won't go sign up just when you get sick, because that increases the cost for everyone.

The best tool today is longevity insurance - they call it income insurance. Most people know the value of life insurance. But what if you live? So instead of trying to guess one or the other, you plan for those 20 years and you get this income insurance. If you live beyond 85, you have money that's guaranteed for as long as you live in the form of an annuity.

The problem or the fundamental flaw of Obamacare was that they put regulations on the insurance, about 12 regulations, which increased the cost of the insurance. And so President Obama wanted to help poor, working-class people, but he actually hurts them by making the insurance too expensive to want to buy. I had someone at the house just recently was doing some work, and he said: "Oh, my son doesn't have insurance, he's paying the penalty because it's too expensive."

President Obama said, oh, we want to make insurance perfect for people, but he added all these regulatory mandates, made it too expensive. Young, healthy people didn't buy it, and the people remaining in the insurance pool were sicker and sicker. That's the adverse selection and the death spiral of Obamacare. And so really we do need to discuss the intricacies of what worked and what didn't work in Obamacare. And I think the better way to do this is to let individuals have the freedom to choose what kind of insurance is best for them. The government doesn't always know best.