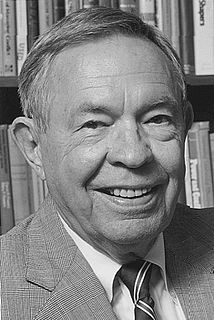

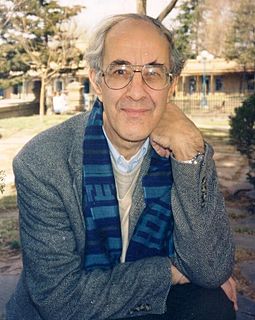

A Quote by Andrew Young

Influence is like a savings account. The less you use it, the more you've got.

Related Quotes

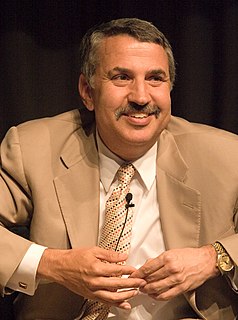

If you want to spend more money in restaurants, use credit cards more than cash. If you want to spend less, use cash more than credit cards. But in general, we can think about how to use the pain of paying and how much of it do we want. And I think we have like a range. Credit cards have very little pain of paying, debit cards have a little bit more because you feel like today, at least it is coming out of your checking account, and cash has much more.

With money we really fool ourselves. We are our biggest enemies with money and there are some things we can do about it. Automatic deductions are a wonderful thing. But ideally, you should wait until the end of the month, you can see how much extra money you had, and you should put that in your savings account. We don't do that too well, and if we did that, we would never save. So, what we do, is we take money out of our pocket into the saving account at the beginning of the month, take it outside of our control and as a consequence, we spend less and we save more.