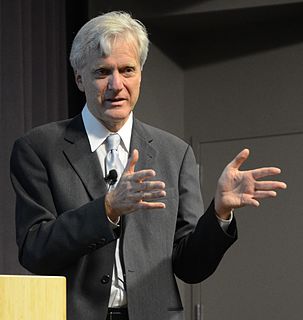

A Quote by Andy Bechtolsheim

Over the long term, absent of other barriers, economics always win.

Related Quotes

Value investing doesn't always work. The market doesn't always agree with you. Over time, value is roughly the way the market prices stocks, but over the short term, which sometimes can be as long as two or three years, there are periods when it doesn't work. And that is a very good thing. The fact that our value approach doesn't work over periods of time is precisely the reason why it continues to work over the long term.

Over the long term, despite significant drops from time to time, stocks (especially an intelligently selected stock portfolio) will be one of your best investment options. The trick is to GET to the long term. Think in terms of 5 years, 10 years and longer. Do your planning and asset allocation ahead of time. Choose a portion of your assets to invest in the stock market - and stick with it! Yes, the bad times will come, but over the truly long term, the good times will win out - and I hope the lessons from 2008 will help get you there to enjoy them.

One thinks that one is winning when we slap tariffs or introduce barriers to imports from another country, and we think we win. But you lose when you export because the other countries are going to raise tariffs as well. They're going to introduce barriers as well. So you win with one hand and you lose with the other.

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.