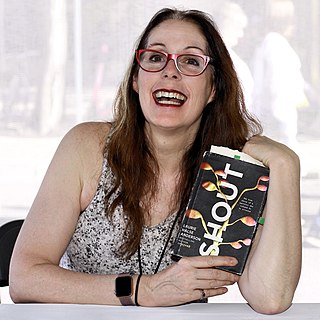

A Quote by Annie Lowrey

Income is now more concentrated in the hands of the rich. Those well-off households tend to save and invest higher proportions of their earnings than middle-class or low-income families do.

Related Quotes

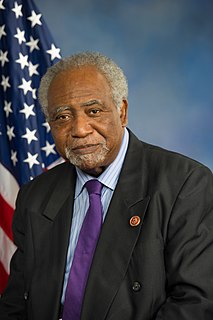

I agree that income disparity is the great issue of our time. It is even broader and more difficult than the civil rights issues of the 1960s. The '99 percent' is not just a slogan. The disparity in income has left the middle class with lowered, not rising, income, and the poor unable to reach the middle class.

Why do we need to support the food stamp program? Because low-income families experience unemployment at a far higher rate than other income groups. Because cutting nutritional assistance programs is immoral and shortsighted, and protecting families from hunger improves their health and educational outcomes.

The people who are having the hard time right now are middle-income Americans. Under the president's policies, middle-income Americans have been buried. They're just being crushed. Middle-income Americans have seen their income come down by $4,300. This is a tax in and of itself. I'll call it the economy tax. It's been crushing.