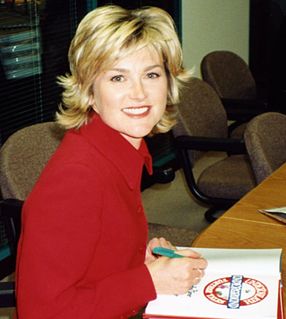

A Quote by Anthea Turner

Maybe, instead of paying so much in tax, the very rich could be incentivised to help their local community and young people who do not have a home.

Related Quotes

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

In 1984, Jean Vanier invited me me to visit L'Arche community in Trosly, France. He didn't say "We need a priest" or "We could use you." He said, "Maybe our community can offer you a home." I visited several times, then resigned from Harvard and went to live with the community for a year. I loved it! I didn't have much to do. I wasn't pastor or anything. I was just a friend of the Community.

I wanted to tell her everything, maybe if I'd been able to, we could have lived differently, maybe I'd be there with you now instead of here. Maybe... if I'd said, 'I'm so afraid of losing something I love that I refuse to love anything,' maybe that would have made the impossible possible. Maybe, but I couldn't do it, I had buried too much too deeply inside me. And here I am, instead of there.

High tax rates in the upper income brackets allow politicians to win votes with class warfare rhetoric, painting their opponents as defenders of the rich. Meanwhile, the same politicians can win donations from the rich by creating tax loopholes that can keep the rich from actually paying those higher tax rates - or perhaps any taxes at all. What is worse than class warfare is phony class warfare. Slippery talk about 'fairness' is at the heart of this fraud by politicians seeking to squander more of the nation's resources.

I love to tell how I'm suffering because one percent we're paying 25 percent of the total. We're not paying 25 percent of the total taxes on individuals. We're paying maybe 25 percent of the income tax, but the payroll tax is over a third of the receipts of the federal government. And they don't take that from me on capital gains. They don't take that from me on dividends. They take from the woman who comes in and takes the wastebaskets out.

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.