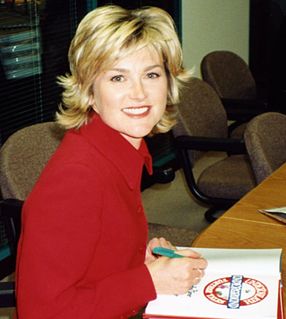

A Quote by Anthea Turner

A lot of people live in a property that will one day be part of their pension, and that is true for me too. I have an investment I can sell with ease.

Related Quotes

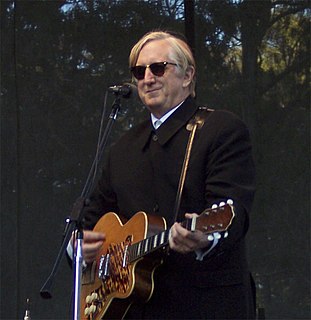

I think everyone should sell whatever product they want to sell for whatever price they want to sell it for, but ultimately the market will dictate what it is and people will have to charge less money for everything. Record companies have been overcharging people for way too long and now this is the trouble that they're in.

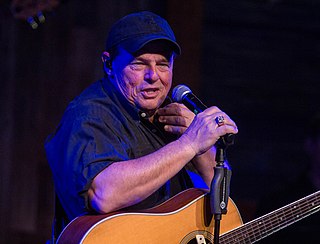

George Jones has been a major part of my personal and professional life for a long time. I have been inspired by his music for the last 50 years and for 42 of those, I had the pleasure of knowing him personally and professionally. He was IT to me. George was and will always be my guy. I am luckier than a lot of people on this Earth because God let me be a part of George's life and him a part of mine. And on this day, his song couldn't be more true: 'He Stopped Loving Her Today.'

If you dropped me off a space platform onto the ground where a line was drawn, I would fall to the left side of it. I believe the difference between right and left is that the right, for the most part, the bulk of their philosophy is interested in property, and the rights of people to own property and gain and acquire and keep property. And I think on the left - though they blend and mix - on the left primarily you will find people who are more concerned about humans, and the human condition, and what can be done.

We live in an age of music for people who don't like music. The record industry discovered some time ago that there aren't that many people who actually like music. For a lot of people, music's annoying, or at the very least they don't need it. They discovered if they could sell music to a lot of those people, they could sell a lot more records.