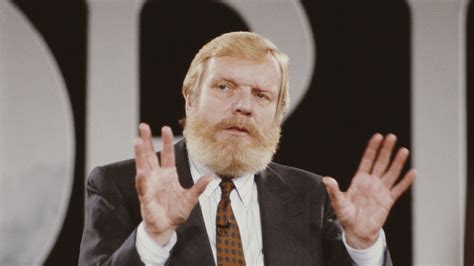

A Quote by Anthony Scaramucci

The most compelling economic and geopolitical story in 2017 will almost certainly revolve around China. The world's most populous country bankrolled an economic boom with high levels of debt and leverage, with which the government is now forced to reckon.

Related Quotes

China, the world's most populous country, 1.3, 1.4 billion people, will in the next decade or so have to begin looking for people outside of China.What does this mean? China will have to become a much more welcoming society. It means that China will have to attract immigrants from other countries in order to slow the aging of the population.

The economic borderlines of our world will not be drawn between countries, but around Economic Domains. Along the twin paths of globalization and decentralization, the economic pieces of the future are being assembled in a new way. Not what is produced by a country or in a country will be of importance, but the production within global Economic Domains, measured as Gross Domain Products. The global market demands a global sharing of talent. The consequence is Mass Customization of Talent and education as the number one economic priority for all countries

The notion of 'world leadership' is a curiously archaic one. The very phrase is redolent of Kipling ballads and James Bondian adventures. What makes a country a world leader? Is it population, in which case India is on course to top the charts, overtaking China as the world's most populous country by 2034?

When people are running up more and more debt for housing, they call that "real wealth." It exposes what's wrong in the mainstream economics and why most of the economics that justifies austerity programs and economic shrinkage is in the textbooks is not scientific. Junk economics denies the role of debt and denies the fact that the economic system we have now is dysfunctional.

I know this is economic jargon, but essentially, if you bring more women to the job market, you create value, it makes economic sense, and growth is improved. There are countries where it's almost a no-brainer: Korea, Japan, soon to be China, certainly Germany, Italy. Why? Because they have an aging population.

In India you would find people who belong to the 10 richest people in the entire world, and you would find people whose poverty levels are sub-Saharan in fact practically: people who would probably make less than a dollar a day or would only have enough for one meal. Now, to have these kinds of contrasts coexist, is something which boggles my mind. We have a country that is making great economic progress, a country that is making his presence felt all over the world, but at the same time, it is unable to deal with some of these fundamental contradictions in our economic evolution.

There is no difference in a country between military, economic, and political affairs. It's useful for Business Insider to divide things that way. That's useful for a college program. But a country is a country. How do you understand China's economy without China's army? If you take these all into account you're ready to explain a question like, "How come the US doesn't have a debt problem?"

Our domestic problems are for the most part economic. We have our enormous debt to pay, and we are paying it. We have the high cost of government to diminish, and we are diminishing it. We have a heavy burden of taxation to reduce, and we are reducing it. But while remarkable progress has been made in these directions, the work is yet far from accomplished.

In the meantime, we have just incredible economic disparities and economic despair in this country and an entire generation that is basically held hostage in debt without the jobs to get out of it. And this is not a world that's working for us, and the climate is going up in flames right now, and the wars are expanding, and we've got 2,000 nuclear weapons on hair-trigger alert. This is not a good picture, and I think the American people are discovering that.