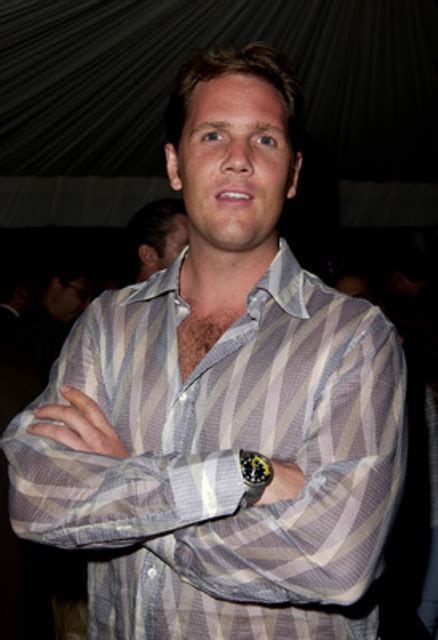

A Quote by Anthony Scaramucci

It's time to stop pretending negative rates have any redeemable value - besides the ability to stimulate the market for physical safes.

Related Quotes

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

You're all Buddhas, pretending not to be. You're all the Christ, pretending not to be. You're all Atman, pretending not to be. You're all love, pretending not to be. You're all one, pretending not to be. You're all Gurus, pretending not to be. You're all God, pretending not to be. When you're ready to stop pretending, then you're ready to just be the real you. That's your home.

To value investors the concept of indexing is at best silly and at worst quite hazardous. Warren Buffett has observed that "in any sort of a contest - financial, mental or physical - it's an enormous advantage to have opponents who have been taught that it's useless to even try." I believe that over time value investors will outperform the market and that choosing to match it is both lazy and shortsighted.

Since 2008 you've had the largest bond market rally in history, as the Federal Reserve flooded the economy with quantitative easing to drive down interest rates. Driving down the interest rates creates a boom in the stock market, and also the real estate market. The resulting capital gains not treated as income.

A higher IOER rate encourages banks to raise the interest rates they charge, putting upward pressure on market interest rates regardless of the level of reserves in the banking sector. While adjusting the IOER rate is an effective way to move market interest rates when reserves are plentiful, federal funds have generally traded below this rate.

If you can stop using substance or stop your addictive behavior for extended periods of time without craving, you are not dependent. You are dependent only if you can't stop without physical or psychological distress (you have unpleasant physical and/or psychological withdrawal symptoms) or if you stop and then relapse.

Whenever I enter a position, I have a predetermined stop. That is the only way I can sleep. I know where I'm getting out before I get in. The position size on a trade is determined by the stop, and the stop is determined on a technical basis... I never think about [stop vulnerability], because the point about a technical barrier - and I've studied the technical aspects of the market for a long time - is that the market shouldn't go there if you are right.

Value investing doesn't always work. The market doesn't always agree with you. Over time, value is roughly the way the market prices stocks, but over the short term, which sometimes can be as long as two or three years, there are periods when it doesn't work. And that is a very good thing. The fact that our value approach doesn't work over periods of time is precisely the reason why it continues to work over the long term.