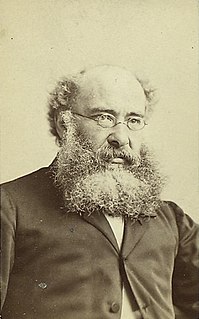

A Quote by Anthony Trollope

After money in the bank, a grudge is the next best thing.

Related Quotes

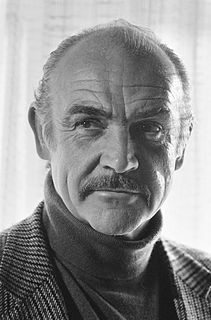

After I began to make some money, my brain-damaged accountant put me in one business after another that went bad. The only one that panned out was a small bank, an old Scottish firm with London offices in Pall Mall. I was a director. We sold out to a larger bank. That was the only successful venture I've had, apart from acting.

What's the best gamble in the world, right now? Its betting that Deutsche Bank stock is going to go down. Short sellers borrowed money from their banks to place bets that Deutsche Bank stock is going to go down. Now, it's wringing its hands and saying, "Oh the speculators are killing us." But it's Deutsche Bank and the other banks that are providing the money to the speculators to bet on credit.

The prairies were dust. Day after day, summer after summer, the scorching winds blew the dust and the sun was brassy in a yellow sky. Crop after crop failed. Again and again the barren land must be mortgaged for taxes and food and next year's seed. The agony of hope ended when there was not harvest and no more credit, no money to pay interest and taxes; the banker took the land. Then the bank failed.

So: if the chronic inflation undergone by Americans, and in almost every other country, is caused by the continuing creation of new money, and if in each country its governmental "Central Bank" (in the United States, the Federal Reserve) is the sole monopoly source and creator of all money, who then is responsible for the blight of inflation? Who except the very institution that is solely empowered to create money, that is, the Fed (and the Bank of England, and the Bank of Italy, and other central banks) itself?

At the base of the Fed pyramid, and therefore of the bank system's creation of "money" in the sense of deposits, is the Fed's power to print legal tender money. But the Fed tries its best not to print cash but rather to "print" or create demand deposits, checking deposits, out of thin air, since its demand deposits constitute the reserves on top of which the commercial banks can pyramid a multiple creation of bank deposits, or "checkbook money."