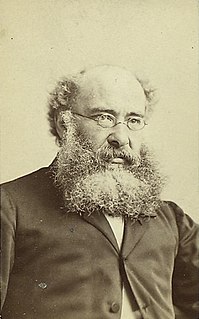

A Quote by Anthony Trollope

A man will be generally very old and feeble before he forgets how much money he has in the funds.

Related Quotes

When an old man and a young man work together, it can make an ugly sight or a pretty one, depending on who's in charge. If the young man's in charge or won't let the old man take over, the young man's brute strength becomes destructive and inefficient, and the old man's intelligence, out of frustration, grows cruel and inefficient. Sometimes the old man forgets that he is old and tries to compete with the young man's strength, and then it's a sad sight. Or the young man forgets that he is young and argues with the old man about how to do the work, and that's a sad sight, too.

Hedge funds are investment pools that are relatively unconstrained in what they do. They are relatively unregulated (for now), charge very high fees, will not necessarily give you your money back when you want it, and will generally not tell you what they do. They are supposed to make money all the time, and when they fail at this, their investors redeem and go to someone else who has recently been making money. Every three or four years they deliver a one-in-a-hundred year flood. They are generally run for rich people in Geneva, Switzerland, by rich people in Greenwich, Connecticut.

When a man spends his own money to buy something for himself, he is very careful about how much he spends and how he spends it. When a man spends his own money to buy something for someone else, he is still very careful about how much he spends, but somewhat less what he spends it on. When a man spends someone else's money to buy something for himself, he is very careful about what he buys, but doesn't care at all how much he spends. And when a man spends someone else's money on someone else, he does't care how much he spends or what he spends it on. And that's government for you.

When I was 23, 24, I started covering hedge funds - a lot of this was luck - when no one else did. This was before hedge funds were the prettiest girl in school: this was pre-nose job and treadmill for hedge funds, when nobody talked to them - back then, it was just all about insurance companies and money managers.

If a man loses a dear friend, he looks around and sees many friends come to console and comfort him. If a man loses his wealth, after a little thought he will realize that the delight that came from wealth will be restored by finding more. Thus he forgets his loss and is consoled. But if a man's heart is deprived of peace, where will he find it again, how will he replace it?

[If a book were] very innocent, and one which might be confided to the reason of any man; not likely to be much read if let alone, but if persecuted, it will be generally read. Every man in the United States will think it a duty to buy a copy, in vindication of his right to buy and to read what he pleases.

The rate of growth of the relevant population is much greater than the rate of growth in funds, though funds have gone up very nicely. But we have been producing students at a rapid rate; they're competing for funds and therefore they're more frustrated. I think there's a certain sense of weariness in the intellectual realm, it's not in any way peculiar to economics, it's a general proposition.