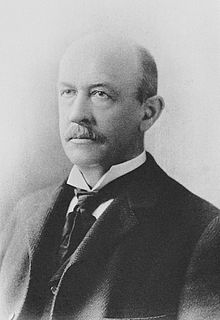

A Quote by Arie de Geus

I admit that one should never underestimate the capacity of banks to destroy enormous amounts of accumulated capital and reduce, temporarily, the supply. After all, capital is the accumulated savings of mankind. And banks are great masters in destroying enormous amounts of capital with great regularity.

Related Quotes

Remember that accumulated knowledge, like accumulated capital, increases at compound interest: but it differs from the accumulation of capital in this; that the increase of knowledge produces a more rapid rate of progress, whilst the accumulation of capital leads to a lower rate of interest. Capital thus checks it own accumulation: knowledge thus accelerates its own advance. Each generation, therefore, to deserve comparison with its predecessor, is bound to add much more largely to the common stock than that which it immediately succeeds.

There is but one means available to improve the material conditions of mankind: to accelerate the growth of capital accumulated as against the growth in population. The greater the amount of capital invested per head of the worker, the more and better goods can be produced and consumed. This is what capitalism, the much abused profit system, has brought about and brings about daily anew. Yet, most present-day governments and political parties are eager to destroy this system.

There's nothing wrong with raising venture capital. Many lean startups are ambitious and are able to deploy large amounts of capital. What differentiates them is their disciplined approach to determining when to spend money: after the fundamental elements of the business model have been empirically validated.

This is the joint responsibility of everyone who was involved in the introduction of the euro without understanding the consequences. When the euro was introduced, the regulators allowed banks to buy unlimited amounts of government bonds without setting aside any equity capital. And the European Central Bank discounted all government bonds on equal terms. So commercial banks found it advantageous to accumulate the bonds of the weaker countries to earn a few extra basis points.

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.

For people who are at the bottom economically, the world is becoming a harder and harder place. And yet the incentives to become rich are so great because enormous amounts of wealth are being accumulated. And so those two things, that carrot and stick, are beating people along this trajectory of trying desperately to move up in the world.