A Quote by Arthur C. Clarke

The best measure of a man's honesty isn't his income tax return. It's the zero adjust on his bathroom scale.

Related Quotes

The 1984 tax trials, when he appealed his New York state and New York City audits, were about Donald Trump claiming zero revenue for his consulting business and taking over $600,000 of deductions, for which he couldn't produce any documentation, no receipts, no checks, nothing, those two elements, zero income and huge deductions, combined with his own tax guy testifying under oath, that's my signature, but I didn't prepare that tax return, those are very strong badges of fraud.

If you look at the performance of the zero-income-tax-rate states and the highest-income-tax-rate states, I believe a large amount of their difference is due to taxes. Not only is it true of the last decade, but I took these numbers back 50 years. And, there's not one year in the last 50 where the zero-income-tax-rate states have not outperformed the highest-income-tax-rate states.

Let's take the nine states that have no income tax and compare them with the nine states with the highest income tax rates in the nation. If you look at the economic metrics over the last decade for both groups, the zero-income-tax-rate states outperform the highest-income-tax-rate states by a fairly sizable amount.

I don't like the income tax. Every time we talk about these taxes we get around to the idea of 'from each according to his capacity and to each according to his needs'. That's socialism. It's written into the Communist Manifesto. Maybe we ought to see that every person who gets a tax return receives a copy of the Communist Manifesto with it so he can see what's happening to him.

We commonly say that the rich man can speak the truth, can afford honesty, can afford independence of opinion and action;--and that is the theory of nobility. But it is the rich man in a true sense, that is to say, not the man of large income and large expenditure, but solely the man whose outlay is less than his income and is steadily kept so.

It makes no difference to a widow with her savings in a 5 percent passbook account whether she pays 100 percent income tax on her interest income during a period of zero inflation or pays no income tax during years of 5 percent inflation. Either way, she is 'taxed' in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 100 percent income tax but doesn't seem to notice that 5 percent inflation is the economic equivalent.

Observe your cat. It is difficult to surprise him. Why? Naturally his superior hearing is part of the answer, but not all of it. He moves well, using his senses fully. He is not preoccupied with irrelevancies. He's not thinking about his job or his image or his income tax. He is putting first things first, principally his physical security. Do likewise.

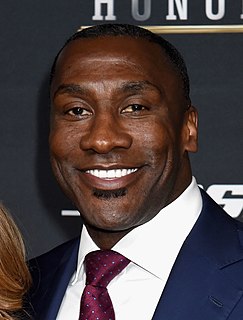

The thing you can't measure is someone's heart, someone's desire. You can measure a 40, his vertical, his bench press, and that might let you know things like, yeah, he can jump high. But desire, his dedication, his determination, that's something you can't measure. That's something you can't measure about Rod Smith.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.