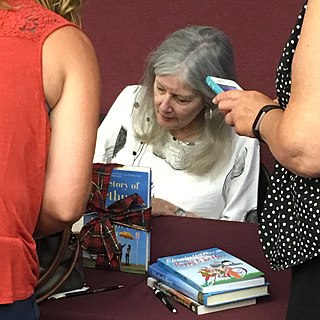

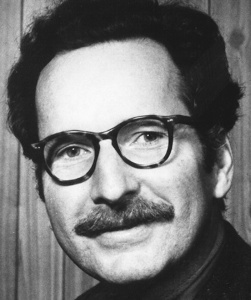

A Quote by Arthur Demarest

One of our great strength, world capitalism, is the most successful economic system possible, but has also become one of shorter and shorter cycles of evaluation. CEOs, companies, stocks, profits and debits change at an ever more accelerated pace in response to the demands of stockholders and the market. We have already experienced some consequences of the shortening cycle of decision making in business, but those are minor in relation to the grand systemic collapse that always eventually results from such accelerating and shortening periods for leadership goals.

Quote Topics

Also

Always

Become

Business

Capitalism

CEOs

Change

Collapse

Companies

Consequences

Cycle

Cycles

Decision

Decision Making

Demands

Economic

Economic System

Evaluation

Eventually

Ever

Experienced

Goals

Grand

Great

Leadership

Making

Market

Minor

More

Most

Our

Pace

Periods

Possible

Profits

Relation

Response

Results

Some

Stocks

Strength

Successful

System

Systemic

Those

World

Related Quotes

Capitalism, the ogre of those protesting Wall Street, has suffered a public relations crisis in the wake of the global economic collapse. But any remedy to the systemic corruption that led to the collapse should not displace recognition that capitalism creates wealth. Capitalism, and no other economic system, has raised millions from poverty around the world.

The collapse of the world's banking system and the impending disaster of accelerating climate change are not separate phenomena. They are simply the most visible symptoms of a particular model of capitalism that will bring civilisation to its knees. But those symptoms will not get sorted unless and until we commit to a radical transformation of the way we create and distribute wealth in the world today

The possible signs of a coming collapse are the same as the greatest strengths of Western civilization: democracy, capitalism, the generally peaceful linking of world economic systems, our amazing success in harnessing the powers of nature to the betterment of the human condition in health, subsistence, longevity. These are the hallmarks of our society - its most successful elements.

How can a country be home to sectarian militias and yet also to people who are educated, sophisticated, and pluralistic? This is not a simple matter. It's the kind of dialectical inquiry that's impossible to present in the world of Twitter feeds and newspapers where stories are shorter and shorter and more simplistic.

The reason we have so much talent in Silicon Valley building and investing in for-profit technology companies is that markets richly reward successful ideas, no matter who invents them. But to remain competitive in a free market, companies must exercise discipline to meet quantitative goals and eventually become cashflow positive.

Henry Ford has several times sneered at unproductive stockholders.... Well, now. Let's see. Who made Henry Ford's own automobile company possible? The stockholders who originally advanced money to him. Who makes it possible for you and me to be carried to and from business by train or street car? Stockholders.... Who made our vast telephone and telegraph service possible? Stockholders.... Were stockholders all over the country to withdraw their capital from the enterprises in which they are invested, there would be a panic ... on a scale never before known.

The challenge here is to design a system where market incentives, including profits and recognition, drive those principles to do more for the poor. I like to call this idea creative capitalism, an approach where governments, businesses, and nonprofits work together to stretch the reach of market forces so that more people can make a profit, or gain recognition, doing work that eases the world's inequities.

Just as outright euphoria is often a sign of a market top, fear is for sure a sign of a market bottom. Time and time again, in every market cycle I have witnessed, the extremes of emotion always appear, even among experienced investors. When the world wants to buy only treasury bills, you can almost close your eys and get long stocks.

Truly world-class firms are always examining their business processes and continuously seeking solutions to improve in key areas, such as lead time reduction, cost cutting, exceeding customer expectations, streamlining processes, shortening time to market for new products, and managing the global operation.