A Quote by Arthur Frederick Saunders

Dean Swift proposed to tax beauty, and to leave every lady to rate her own charms; he said the tax would be cheerfully paid and very productive.

Related Quotes

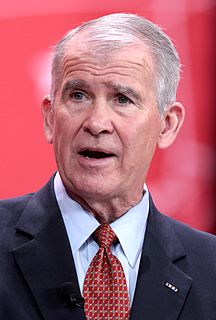

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

If top marginal income tax rates are set too high, they discourage productive economic activity. In the limit, a top marginal income tax rate of 100 percent would mean that taxpayers would gain nothing from working harder or investing more. In contrast, a higher top marginal rate on consumption would actually encourage savings and investment. A top marginal consumption tax rate of 100 percent would simply mean that if a wealthy family spent an extra dollar, it would also owe an additional dollar of tax.

I would favor three policies: raising the minimum wage to $12, closing the tax loophole where persons only pay a 15% income tax on long term capital gains (tax it at the full tax rate), and institute a progressive tax moving the highest tax rate from 39.6% to 45%. I would favor implementing these three policies in that order, starting with raising the minimum wage, but not stopping there.

Here's the truth. The proposed top rate of income tax is not 50 per cent. It is 50 per cent plus 1.5 per cent national insurance paid by employees plus 13.3 per cent paid by employers. That's not 50 per cent. Two years from now, Britain will have the highest tax rate on earned income of any developed country.

According to the IRS, the wealthiest 400 Americans, who earned an average of roughly $270 million in 2008, paid an average tax rate of just 18.2 percent that year. That's about the same rate paid by a single truck driver in Rhode Island. It's not right, and we need to restore fairness to our tax code.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

If you look at the performance of the zero-income-tax-rate states and the highest-income-tax-rate states, I believe a large amount of their difference is due to taxes. Not only is it true of the last decade, but I took these numbers back 50 years. And, there's not one year in the last 50 where the zero-income-tax-rate states have not outperformed the highest-income-tax-rate states.

I want to end tax dumping. States that have a common currency should not be engaged in tax competition. We need a minimum tax rate and a European finance minister, who would be responsible for closing the tax loopholes and getting rid of the tax havens inside and outside the EU. It is also clear that we have to reach common standards in our economic and labor policies. We cannot continue to just talk about technical details. We have to inspire enthusiasm in Germany for Europe.

God forbid that the United Kingdom should take a lead and introduce a sensible tax system of its own which would probably comprise a very low level of corporation tax - tax on corporate profits - and perhaps a low level of corporate sales tax, because sales are where they are, and sales in this country are sales here, which we can tax here.