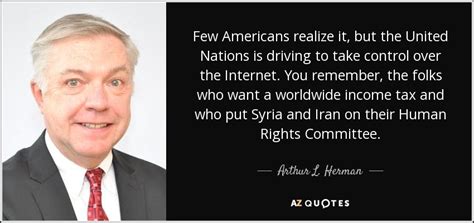

A Quote by Arthur L. Herman

Few Americans realize it, but the United Nations is driving to take control over the Internet. You remember, the folks who want a worldwide income tax and who put Syria and Iran on their Human Rights Committee.

Related Quotes

Unfortunately, the United States and a few other governments have used the war on terrorism as a way of violating human rights. I am referring to the case of the Guantánamo Bay prisoners. This violation of the rights of prisoners has been so unbelievable that the United Nations has reminded the United States repeatedly that the treatment of prisoners should take place according to the preestablished conventions of the United Nations.

The people who are having the hard time right now are middle-income Americans. Under the president's policies, middle-income Americans have been buried. They're just being crushed. Middle-income Americans have seen their income come down by $4,300. This is a tax in and of itself. I'll call it the economy tax. It's been crushing.

In the United States, Iran is nothing but a whipping-boy. Few Americans have any real use for Iran. Most of us, what we know and remember about Iran are things like the hostage crisis in 1980, or they think about the Iranian attacks in Lebanon, or on the Khobar Towers. So you don't get a whole lot of political mileage in the United States by going out and advocating better relations with the Iranians.

Let's take the nine states that have no income tax and compare them with the nine states with the highest income tax rates in the nation. If you look at the economic metrics over the last decade for both groups, the zero-income-tax-rate states outperform the highest-income-tax-rate states by a fairly sizable amount.

There are 11 states in the United States that in the last 50 years instituted an income tax. So I looked at each of those 11 states over the last 50 years, and I took their current economic metrics and their metrics for the five years before they put in the progressive income tax... Every single state that introduced a progressive income tax has declined as an overall share of the U.S. economy.

It is up to each and every one of us to raise our voice against crimes that deprive countless victims of their liberty, dignity and human rights. We have to work together to realize the equal rights promised to all by the United Nations Charter. And we must collectively give meaning to the words of the Universal Declaration of Human Rights that "no one shall be held in slavery or servitude"

The United Nations should come in and take over Liberia, not temporarily, but for life. To make Liberians believe in democracy, to make us believe in human rights, they need to go in and just seize control of the country. That is the only way Liberia will ever become the kind of country it was supposed to be.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

Norway, Iceland, Australia, Canada, Sweden, Switzerland, Belgium, Japan, the Netherlands, Denmark, and the United Kingdom are among the least religious societies on earth. According to the United Nations' Human Development Report (2005), they are also the healthiest, as indicated by life expectancy, adult literacy, per capita income, educational attainment, gender equality, homicide rate, and infant mortality. . . . Conversely, the fifty nations now ranked lowest in terms of the United Nations' human development index are unwaveringly religious.

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.

It was not until the Abraham Lincoln administration that an income tax was imposed on Americans. Its stated purpose was to finance the war, but it took until 1872 for it to be repealed. During the Grover Cleveland administration, Congress enacted the Income Tax Act of 1894. The U.S. Supreme Court ruled it unconstitutional in 1895. It took the Sixteenth Amendment (1913) to make permanent what the Framers feared -- today's income tax.