A Quote by Arthur Laffer

Over the past 100 years, there have been three major periods of tax-rate cuts in the U.S.: the Harding-Coolidge cuts of the mid-1920s; the Kennedy cuts of the mid-1960s; and the Reagan cuts of the early 1980s. Each of these periods of tax cuts was remarkably successful as measured by virtually any public policy metric.

Related Quotes

After 25 quarters of so-called recovery under Obama, it has increased a total of only 14.3 percent. Compare this to earlier periods. After the JFK tax cuts of the early 1960s, the economy grew in total by roughly 40 percent. After the Reagan tax cuts of the 1980s, the economy grew by a total of 34 percent.

His presidency ended more than a decade ago, but politicians, Democrat and Republican, still talk about Ronald Reagan. Al Gore has an ad noting that in Congress he opposed the Reagan budget cuts. He says that because Bill Bradley was one of 36 Democratic Senators who voted for the cuts. Gore doesn’t point out that Bradley also voted against the popular Reagan tax cuts and that it was the tax cuts that piled up those enormous deficits, a snowballing national debt.

If we can’t puncture some of the mythology around austerity, politics or tax cuts or the mythology that’s been built up around the Reagan revolution, where somehow people genuinely think that he slashed government and slashed the deficit and that the recovery was because of all these massive tax cuts, as opposed to a shift in interest-rate policy - if we can’t describe that effectively, then we’re doomed to keep on making more and more mistakes.

Look, I'm very much in favor of tax cuts, but not with borrowed money. And the problem that we've gotten into in recent years is spending programs with borrowed money, tax cuts with borrowed money, and at the end of the day that proves disastrous. And my view is I don't think we can play subtle policy here.

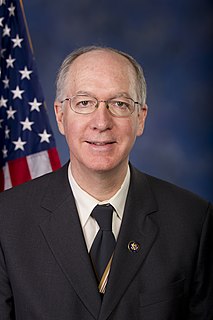

Democrats in Washington predicted that tax cuts would not create jobs, would not increase wages, and would cause the federal deficit to explode. Well, the facts are in. The tax cuts have led to a strong economy. Real wages were on the rise, and deficit has been cut in half three years ahead of schedule.

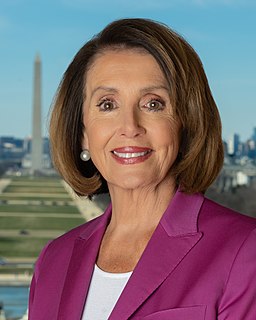

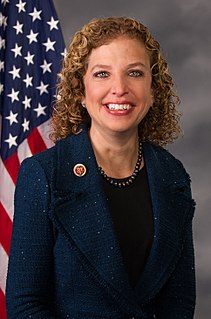

We certainly could have voted on making the middle-class tax cuts and tax cuts for working families permanent had the Republicans not insisted that the only way they would support those tax breaks is if we also added $700 billion to the deficit to give tax breaks to the wealthiest 2 percent of Americans. That's what was really disturbing.