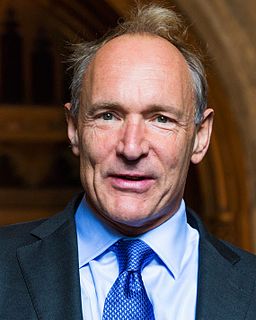

A Quote by Ashok Soota

Over 10 years, MindTree has been ahead of most IT companies on operating and financial metrics. We have stayed true to our long-term vision and have not been buffeted by short-term.

Related Quotes

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.

Over the long term, despite significant drops from time to time, stocks (especially an intelligently selected stock portfolio) will be one of your best investment options. The trick is to GET to the long term. Think in terms of 5 years, 10 years and longer. Do your planning and asset allocation ahead of time. Choose a portion of your assets to invest in the stock market - and stick with it! Yes, the bad times will come, but over the truly long term, the good times will win out - and I hope the lessons from 2008 will help get you there to enjoy them.

The most challenging thing for a young entrepreneur is to think long-term. When you are 22 years old, it’s hard to think in 22-year increments since that’s as long as you’ve been alive. But it’s really important to view your life as an entrepreneur as a long journey that consists of many short-term cycles.