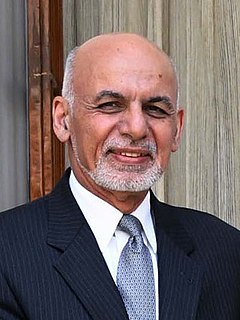

A Quote by Ashraf Ghani

Money is not capital in most of the developing countries. It's just cash. Because it lacks the institutional, organizational, managerial forms to turn it into capital.

Related Quotes

State funds, private equity, venture capital, and institutional lending all have their role in the lifecycle of a high tech startup, but angel capital is crucial for first-time entrepreneurs. Angel investors provide more than just cash; they bring years of expertise as both founders of businesses and as seasoned investors.

If, for example, each of us had the same share of capital in the national total capital, then if the share of capital goes up it's not a problem, because you get as much as I do. The problem is that capital in capitalist countries is very heavily concentrated, especially financial capital. So then if the share of income from that source goes up, that actually exacerbates inequality.

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.

Throughout the industrial era, economists considered manufactured capital - money, factories, etc. - the principal factor in industrial production, and perceived natural capital as a marginal contributor. The exclusion of natural capital from balance sheets was an understandable omission. There was so much of it, it didn't seem worth counting.