A Quote by Austan Goolsbee

That is what happened in 2010. The administration and the leadership of the Republicans thought, 'Well, we're making a deal together; we're showing the world things can be done in a bi-partisan way. We're extending all our tax cuts for two years.'

Related Quotes

We certainly could have voted on making the middle-class tax cuts and tax cuts for working families permanent had the Republicans not insisted that the only way they would support those tax breaks is if we also added $700 billion to the deficit to give tax breaks to the wealthiest 2 percent of Americans. That's what was really disturbing.

I'm the first secretary of defense that's had to deal with sequestration. I've prepared two budgets that deal with sequestration. And you bring the chiefs together, the leadership of this enterprise together, to work through, how do we then take these cuts? Where do we apply those cuts? Readiness is the first thing that suffers.

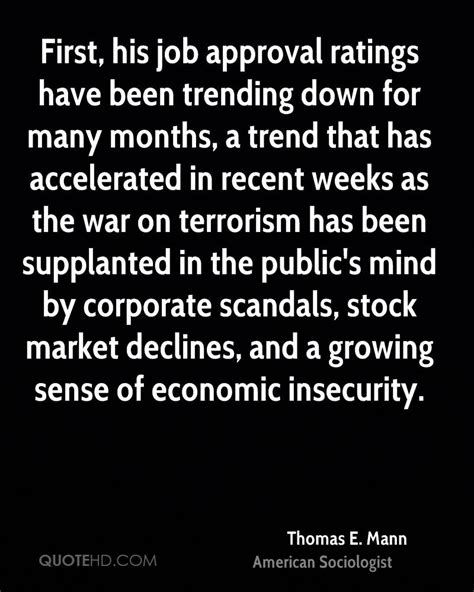

The reason we've been growing at 1.8 percent for the last eight, ten years, which is way below the historical average, is in large part because of our tax code. It is important to us to get the biggest, broadest tax reduction, tax cuts, tax reform that we can possibly get because it's the only way we get back to 3 percent growth. That's what's driving all of this, how do you get the American economy back on that historical growth rate of 3 percent and out of these doldrums of 1.8, 1.9 that we had of the previous Barack Obama administration?

What the Trump tax plan is a plan to give tiny little tax cuts to most Americans, raise taxes on perhaps one in five families and shower benefits on people who earn millions of dollars a year. And this fits with a fundamental principle the Republicans have been pursuing for a long time. The rich aren't investing and creating jobs, because they don't have nearly enough money, and so we need to get them money. And the way the Republicans want to get it to them is tax cuts first, and then to take away help for children, the disabled, the elderly and the poor.

Over the past 100 years, there have been three major periods of tax-rate cuts in the U.S.: the Harding-Coolidge cuts of the mid-1920s; the Kennedy cuts of the mid-1960s; and the Reagan cuts of the early 1980s. Each of these periods of tax cuts was remarkably successful as measured by virtually any public policy metric.

In December, I agreed to extend the tax cuts for the wealthiest Americans because it was the only way I could prevent a tax hike on middle-class Americans. But we cannot afford $1 trillion worth of tax cuts for every millionaire and billionaire in our society. We can't afford it. And I refuse to renew them again.

I may sound naive, since everyone's decided the next two years are going to be all about 2016, but I look at what's happened over the years when there's been divided government. That's when we've done tax reform, that's when we've done entitlement reform - to move this economy forward on these big issues.