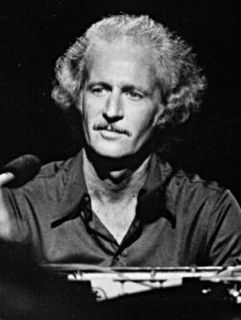

A Quote by Austan Goolsbee

We've gone through rounds of tax cutting and rounds of tax increases in modern U.S. history. We haven't really had a big igniting of a trade war belligerence since the Depression era, and that's not an era that we want to repeat.

Related Quotes

When I first got into the sport it was all about who could cut the most weight, who could be the biggest on fight night. That's the same era when you're sparring 10 five minute rounds, new partner every two and a half minutes, that era of just really hard weight cutting and really hard full contact training.

Trump himself stands to benefit dramatically from the tax cuts. One of the things they're cutting is the alternative minimum tax. Last time we have tax returns for him was in 2005, where he paid about $31 million because of the alternative minimum tax. He won't have to pay that, if this tax bill goes through. So, not only is he reordering our constitutional democracy, he is personally enriching himself - which is not new, because, of course, he's done it ever since he swore an oath to become president of the United States.