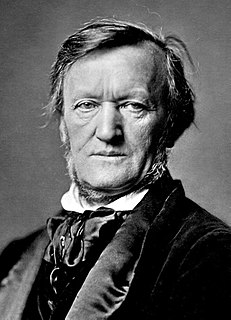

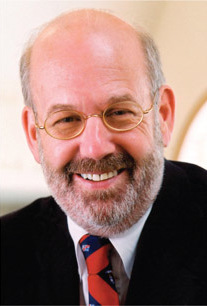

A Quote by Ayn Rand

Inflation is not caused by the actions of private citizens, but by the government: by an artificial expansion of the money supply required to support deficit spending. No private embezzlers or bank robbers in history have ever plundered people's savings on a scale comparable to the plunder perpetrated by the fiscal policies of statist governments.

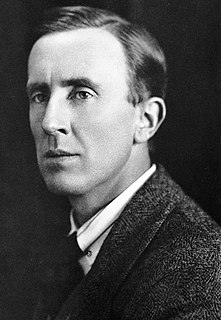

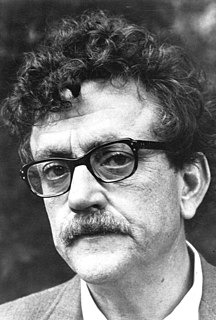

Related Quotes

Whether government finances its added spending by increasing taxes, by borrowing, or by inflating the currency, the added spending will be offset by reduced private spending. Furthermore, private spending is generally more efficient than the government spending that would replace it because people act more carefully when they spend their own money than when they spend other people's money.

The greatest threat facing America today

is the disastrous fiscal policies of our own government,

marked by shameless deficit spending and

Federal Reserve currency devaluation.

It is this one-two punch -

Congress spending more than it can tax or borrow,

and the Fed printing money to make up the difference -

that threatens to impoverish us by further

destroying the value of our dollars.

So: if the chronic inflation undergone by Americans, and in almost every other country, is caused by the continuing creation of new money, and if in each country its governmental "Central Bank" (in the United States, the Federal Reserve) is the sole monopoly source and creator of all money, who then is responsible for the blight of inflation? Who except the very institution that is solely empowered to create money, that is, the Fed (and the Bank of England, and the Bank of Italy, and other central banks) itself?

Since the government creates no wealth, it can only transfer the wealth required to hire people. Even if the government creates a million jobs, that is not a net increase in jobs, when the money that pays for those jobs is taken from the private sector, which loses that much ability to create private jobs.

If government manages to establish paper tickets or bank credit as money, as equivalent to gold grams or ounces, then the government, as dominant money-supplier, becomes free to create money costlessly and at will. As a result, this 'inflation' of the money supply destroys the value of the dollar or pound, drives up prices, cripples economic calculation, and hobbles and seriously damages the workings of the market economy.

If you have a private firm and you spend a ton of money to pay employees, but what you produce is a flop, there will be no value to GDP. But government spending all gets counted as contributing to economic growth. That's why in the early days of creating these measurements, some people didn't want to count government spending.

Never forget that no government has wealth of its own to spend. The money has to come from taxation, monetary inflation, or debt expansion that must be paid later. And government's spending choices will always be uneconomic relative to how society would use that wealth. That is to say, the money will be wasted.

If you wanted to create jobs in a way that has minimal effect on the deficit but has government action, the two best things you could do are the infrastructure bank and a simple SBA-like loan guarantee for all building retrofits, where the contractor or the energy-service company guarantees the savings. So that allows the bank to loan money to let a school or a college or a hospital or a museum or a commercial building unencumbered by debt to loan it on terms that are longer, so you can pay it back only from your utility savings. You could create a million jobs doing that.