A Quote by Baiju Bhatt

The fact that a lot of people, especially younger folks, are not investing in the stock market is something we really think needs addressing.

Related Quotes

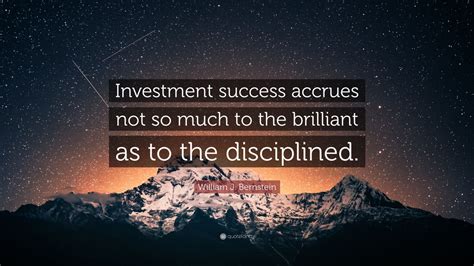

Speculators are obsessed with predicting: guessing the direction of stock prices. Every morning on cable television, every afternoon on the stock market report, every weekend in Barron's, every week in dozens of market newsletters, and whenever business people get together. In reality, no one knows what the market will do; trying to predict it is a waste of time, and investing based upon that prediction is a purely speculative undertaking.

There is a bit of a problem with the match between derivative securities markets and the primary markets. We have long ago instituted principles, essentially high margin requirements, to prevent certain instabilities in the stock market, and I think they're basically correct. The trouble is that there's a linkage, let's say, between something like the stock market and the index futures markets, and the fact that the margin requirements are very different, for example, played some role in the October '87 crash.

There is the fact that - people have had a lot of confidence that the Chinese leadership could fix what is wrong with their economy so it wouldn't have ripple effects around the world. I think that confidence is being shaken by how difficult it is for them to manage their stock market and their currency.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

An index fund is a fund that simply invests in all of the stocks in a market. So, for example, an index fund might invest in every single stock or almost every single stock in the U.S. market, it might invest in every single stock abroad, or it might invest in all of the bonds that are out there. And you can make a perfectly fine investing portfolio that mixes equal parts of all three of those.