A Quote by Baiju Bhatt

Margin trading will drive the lion's share of our revenue, which is like a loan that lets people have more money to trade with.

Related Quotes

The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading… I know this will sound like a cliché, but the single most important reason that people lose money in the financial markets is that they don't cut their losses short.

Don’t ever average losers. Decrease your trading volume when you are trading poorly; increase your volume when you are trading well. Never trade in situations where you don’t have control. For example, I don’t risk significant amounts of money in front of key reports, since that is gambling, not trading.

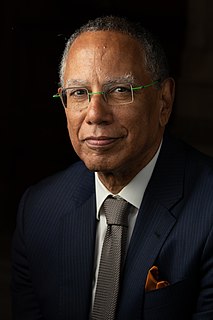

I also don't think all of the revenue will come from digital subscriptions. We have in the New York Times a mix of revenue sources and it will continue to be a mix for quite a while. What makes me more nervous is that we built this newsroom on a really high profit margin that has eroded significantly over the last years. I'm nervous that we won't continue to have the profit margins that allow us to have a big, robust newsroom.

The Internet is all about accessing entertainment. Realistically, 50 to 80 percent of all traffic is people downloading stuff for free. If you can turn that huge market share into something that you can monetize, even if it is just with ads, you will end up making more money than with all other revenue streams combined.

I have endeavoured to show that the ability to pay taxes depends, not on the gross money value of the mass of commodities, nor on the net money value of the revenue of capitalists and landlords, but on the money value of each man's revenue compared to the money value of the commodities which he usually consumes.