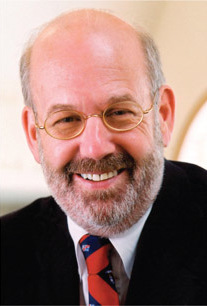

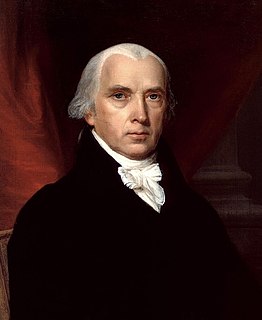

A Quote by Barack Obama

I'd like to help struggling homeowners who can't pay their mortgages, I'd like to invest in our crumbling infrastructure, I'd like to reform the tax system so multimillionaires can't pretend their earnings are capital gains and pay at the rate of 15 percent. I'd like to make public higher education free, and pay for it with a small transfer tax on all financial transactions. I'd like to do much more - a new new deal for Americans. But Republicans are blocking me at every point.

Quote Topics

Blocking

Capital

Capital Gains

Crumbling

Crumbling Infrastructure

Deal

Earnings

Education

Every

Financial

Free

Gains

Help

Higher

Higher Education

Homeowners

Infrastructure

Invest

Like

Make

Me

More

Much

New

New Deal

Our

Pay

Percent

Point

Pretend

Public

Rate

Reform

Republicans

Small

Struggling

System

Tax

Tax System

Transactions

Transfer

Related Quotes

You got to remember, S corporations pay one layer of tax, corporations pay two layers of tax. So we basically see equivalent, but here`s the point. The rest of the world, they tax their businesses at an average rate in the industrialized world of 23 percent. Our corporate is 35. Our top S corporate, small business rate is 44.6 effectively. This is killing us.

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

I would favor three policies: raising the minimum wage to $12, closing the tax loophole where persons only pay a 15% income tax on long term capital gains (tax it at the full tax rate), and institute a progressive tax moving the highest tax rate from 39.6% to 45%. I would favor implementing these three policies in that order, starting with raising the minimum wage, but not stopping there.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

Why do we fully tax some kinds of income from capital, like interest and dividends; partially tax other kinds like capital gains; defer tax on other kinds, like IRAs; and impose no tax at all on still other types of capital income, like interest on municipal bonds? This simply is not rational. These distinctions don't have any inherent logic.

The most absurd public opinion polls are those on taxes. Now, if there is one thing we know about taxes, it is that people do not want to pay them. If they wanted to pay them, there would be no need for taxes. People would gladly figure out how much of their money that the government deserves and send it in. And yet we routinely hear about opinion polls that reveal that the public likes the tax level as it is and might even like it higher. Next they will tell us that the public thinks the crime rate is too low, or that the American people would really like to be in more auto accidents.

I think we should have basically the same tax policy that Germany, Japan, the U.K., everybody else has, which is a tax rate in the mid-20s and no loopholes. Zero. The U.S. has the most antiquated tax system. And that means some people are going to pay more taxes, and some people are going to pay less.

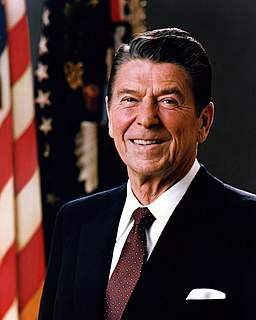

Now, the president would like to do tax reform, which would obviously lower rates for most people in America and make the tax code fair and get rid of loopholes and special treatment. But absent tax reform, the president believes the right way to get our fiscal house in order is ask the wealthy to pay their fair share.

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.

My dad's from that generation like a lot of immigrants where he feels like if you come to this country, you pay this thing like the American dream tax: like you're going to endure some racism, and if it doesn't cost you your life, well hey, you lucked out. Pay it; there you go, Uncle Sam. I was born here, so I actually had the audacity of equality.