A Quote by Barack Obama

So I'm not proposing anything radical. I just believe that anybody making over $250,000 a year should go back to the income tax rates we were paying under Bill Clinton. Back when our economy created nearly 23 million new jobs, the biggest budget surplus in history, and plenty of millionaires to boot. ... At the same time, most people agree that we should not raise taxes on middle-class families or small businesses -- not when so many folks are just trying to get by.

Quote Topics

Agree

Anybody

Anything

Back

Back When

Believe

Biggest

Bill

Bill Clinton

Boot

Budget

Businesses

Class

Clinton

Created

Economy

Families

Folks

Get

Go

History

Income

Income Tax

Jobs

Just

Just Be

Just Believe

Making

Many

Middle

Million

Millionaires

Most

Nearly

New

New Job

Our

Over

Paying

People

Plenty

Radical

Raise

Rates

Same

Same Time

Should

Small

Small Business

Small Businesses

Surplus

Tax

Tax Rate

Tax Rates

Taxes

Time

Trying

Were

Year

Related Quotes

I want to reform the tax code so that it's simple, fair, and asks the wealthiest households to pay higher taxes on incomes over $250,000 - the same rate we had when Bill Clinton was president; the same rate we had when our economy created nearly 23 million new jobs, the biggest surplus in history, and a lot of millionaires to boot.

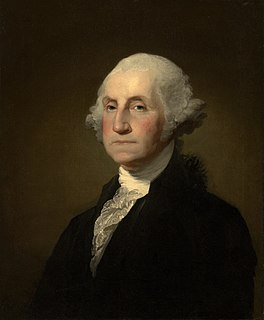

My tax plan will cut taxes for 95 percent of workers, because we need to put money back into the pockets of struggling middle-class families and close the egregious tax loopholes that have exploded over the last eight years. My plan eliminates capital gains taxes entirely for the small businesses and start-ups that are the backbone of our economy, as opposed to John McCain's plan, which would tax these businesses. John McCain is running to serve out a third Bush term. But the truth is, when it comes to taxes, that's not being fair to George Bush.

It is a paradoxical truth that tax rates are too high and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now Cutting taxes now is not to incur a budget deficit, but to achieve the more prosperous, expanding economy which can bring a budget surplus.

For the workers and their families, being able to bring home a living wage helps their families and, by extension, helps our economy. Seventy percent of our economy is consumer-based. We know that when lower- and middle-class families have money and disposable income, they spend it. That puts money back into the economy. It's a win-win for everybody: Not just for the individual, not just production at a specific company (like Nissan), but for the greater good.

All those predictions about how much economic growth will be created by this, all of those new jobs, would be created by the things we wanted - the extension of unemployment insurance and middle class tax cuts. An estate tax for millionaires adds exactly zero jobs. A tax cut for billionaires - virtually none.