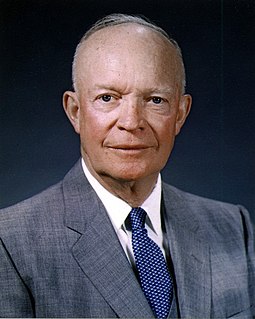

A Quote by Barack Obama

In the absence of sound oversight,responsible businesses are forced to compete against unscrupulous and underhanded businesses, who are unencumbered by any restrictions on activities that might harm the environment, or take advantage of middle-class families, or threaten to bring down the entire financial system.

Related Quotes

In the absence of sound oversight, responsible businesses are forced to compete against unscrupulous and underhanded businesses, who are unencumbered by any restrictions on activities that might harm the environment, or take advantage of middle-class families, or threaten to bring down the entire financial system.

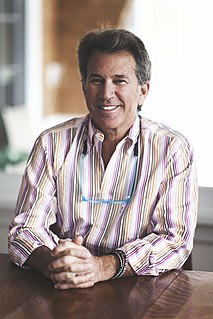

I think that today, more so than ever, corporate responsibility is the best strategic as well as financial path that most businesses can follow. For most businesses there are both compelling reasons to be responsible and compelling statistics that validate that responsible businesses do better according to traditional financial metrics. Of course, how you define "responsible" is somewhat of a conundrum.

When the government takes more money out of the pockets of middle class Americans, entrepreneurs, and businesses, it lessens the available cash flow for people to spend on goods and services, less money to start businesses, and less money for businesses to expand - i.e. creating new jobs and hiring people.

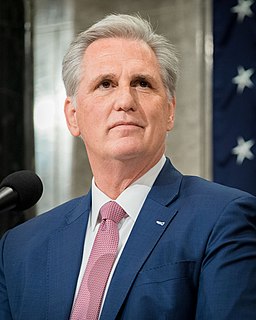

Congress can protect small businesses by providing effective oversight over SBA policies and make sure they take into account the needs of small businesses while also protecting taxpayer dollars. Congress also needs to make sure that new banking regulations do not make it more costly for community banks to lend to small businesses.

We're going to have to invest in the American people again, in tax cuts for the middle class, in health care for all Americans, and college for every young person who wants to go. In businesses that can create the new energy economy of the future. In policies that will lift wages and will grow our middle class. These are the policies I have fought for my entire career.