A Quote by Barack Obama

And I want to work with this Congress, to make sure Americans already burdened with student loans can reduce their monthly payments, so that student debt doesn't derail anyone's dreams.

Related Quotes

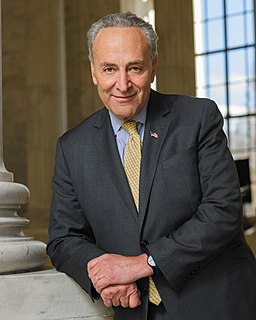

Student debt is crushing the lives of millions of Americans. How does it happen that we can get a home mortgage or purchase a car with interest rates half of that being paid for student loans? We must make higher education affordable for all. We must substantially lower interest rates on student loans. This must be a national priority.

Escrow accounts are an important tool for homeowners to the reduce the risk of mortgage default on high-priced loans. Millions of Americans, including my wife and I, utilize these accounts to make monthly payments towards the annual financial obligations that come with homeownership like taxes and insurance.

This is a derivative, if you will, of Cloward-Piven [theory]. "[Stephen] Lerner's plan is to organize a mass, coordinated 'strike' on mortgage, student loan, and local government debt payments - thus bringing the banks to the edge of insolvency and forcing them to renegotiate the terms of the loans.

So we are in for years of debt deflation. That means that people have to pay so much debt service for mortgages, credit cards, student loans, bank loans and other obligations

that they have less to spend on goods and services. So markets shrink. New investment and employment fall off, and the economy is falls into a downward spiral.

Debt is so ingrained into our culture that most Americans can't even envision a car without a payment ... a house without a mortgage ... a student without a loan ... and credit without a card. We've been sold debt with such repetition and with such fervor that most folks can't conceive of what it would be like to have NO payments.

A Student is the most important person ever in this school...in person, on the telephone, or by mail.

A Student is not dependent on us...we are dependent on the Student.

A Student is not an interruption of our work..the Studenti s the purpose of it. We are not doing a favor by serving the Student...the Student is doing us a favor by giving us the opportunity to do so.

A Student is a person who brings us his or her desire to learn. It is our job to handle each Student in a manner which is beneficial to the Student and ourselves.

Debt is a trap, especially student debt, which is enormous, far larger than credit card debt. It’s a trap for the rest of your life because the laws are designed so that you can’t get out of it. If a business, say, gets in too much debt it can declare bankruptcy, but individuals can almost never be relieved of student debt through bankruptcy.

Debt is a trap, especially student debt, which is enormous, far larger than credit card debt. It's a trap for the rest of your life because the laws are designed so that you can't get out of it. If a business, say, gets in too much debt, it can declare bankruptcy, but individuals can almost never be relieved of student debt through bankruptcy.

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.

The current U.S. and Eurozone depression isn't because of China. It's because of domestic debt deflation. Commodity prices and consumer spending are falling, mainly because consumers have to pay most of their wages to the FIRE sector for rent or mortgage payments, student loans, bank and credit card debt, plus over 15 percent FICA wage withholding for Social Security and Medicare actually, to enable the government to cut taxes on the higher income brackets, as well income and sales taxes.