A Quote by Barack Obama

I very much believe in reforming the tax system.

Related Quotes

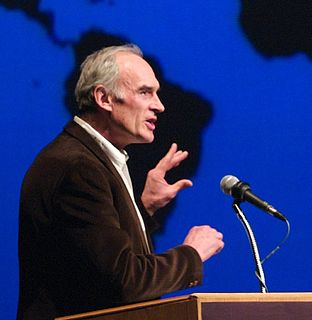

I believe we're at the verge of the greatest time to be alive in this world. But Washington is holding us back. How we tax, how we regulate. We're not embracing the energy revolution in our midst, a broken immigration system that has been politicized rather than turning it into an economic driver. We're not protecting and preserving our entitlement system or reforming for the next generation. All these things languish while we have politicians in Washington using these as wedge issues.

God forbid that the United Kingdom should take a lead and introduce a sensible tax system of its own which would probably comprise a very low level of corporation tax - tax on corporate profits - and perhaps a low level of corporate sales tax, because sales are where they are, and sales in this country are sales here, which we can tax here.

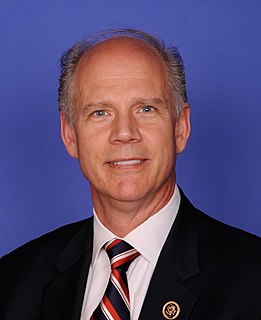

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.