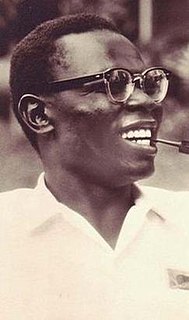

A Quote by Barack Obama, Sr.

Theoretically, there is nothing that can stop the government from taxing 100 per cent of income so long as the people get benefits from the government commensurate with their income which is taxed.

Related Quotes

Here's the truth. The proposed top rate of income tax is not 50 per cent. It is 50 per cent plus 1.5 per cent national insurance paid by employees plus 13.3 per cent paid by employers. That's not 50 per cent. Two years from now, Britain will have the highest tax rate on earned income of any developed country.

It makes no difference to a widow with her savings in a 5 percent passbook account whether she pays 100 percent income tax on her interest income during a period of zero inflation or pays no income tax during years of 5 percent inflation. Either way, she is 'taxed' in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 100 percent income tax but doesn't seem to notice that 5 percent inflation is the economic equivalent.

We've been prepared to make the arguments for lowering corporation tax, which is all about encouraging risk takers, encouraging entrepreneurs, and I observe that for the vast majority of the Labour government we had a top rate of 40 per cent income tax. It's now higher, and I think we should look to get to a simpler, lower tax system.

The tax that was supposed to soak the rich has instead soaked America. The beneficiary of the income tax has not been the poor, but big government. The income tax has given us a government bureaucracy that outnumbers the manufacturing work force. It has created welfare dependencies that have entrapped millions of Americans in an underclass that is forced to live a sordid existence of trading votes for government handouts.