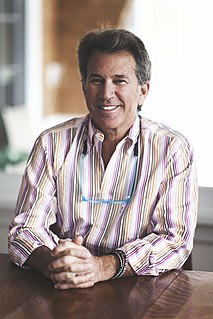

A Quote by Barry Diller

There's no way you can predict what is going to happen in six months or two years in most businesses, and certainly not for businesses that are growing at the rate that we have grown.

Related Quotes

If you look at America, one of the great strengths of America is its university towns and the way a lot of their businesses and a lot of their innovation and enormous economic growth have come from reducing that gap, getting those universities directly involved in start-up businesses, green field businesses, new development businesses.

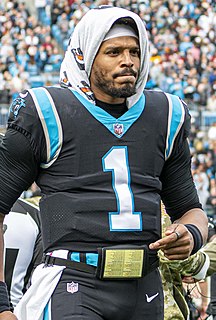

I'm not going to entertain something that took place not three months, not six months, not a year but two years ago. I'm not going to sit up here and say anything about it, whether I did or did not do it, because I don't want to beat a dead horse talking about it. It's not going to affect me any way, shape or fashion.

I think that today, more so than ever, corporate responsibility is the best strategic as well as financial path that most businesses can follow. For most businesses there are both compelling reasons to be responsible and compelling statistics that validate that responsible businesses do better according to traditional financial metrics. Of course, how you define "responsible" is somewhat of a conundrum.

Capitalism is the best way of organizing economic activity for a lot of reasons. It unlocks a higher fraction of human potential, it balances supply and demand, it's more consistent with higher levels of freedom. But the way we're pursuing it now, focuses on such short-term horizons, that a lot of businesses and investors are tempted to look at investments in terms of what's gonna happen in the next 90 days, what's gonna happen in one year. But the old phrase, "Good things take time," is true of successful businesses as well.