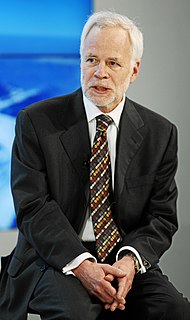

A Quote by Barry Eichengreen

As for the single market, the E.U.'s landmark achievement, there is no question that a euro zone breakup would severely disrupt its operation in the short run.

Related Quotes

There is no question that a breakup of the euro would be very damaging, very costly, both financially and politically. And the biggest loss would be incurred by Germany. Germans have to bear in mind that, effectively, they have suffered practically no losses so far. Transfers have all been in the form of loans, and it is only when the loans are not repaid that real losses will be incurred.

I don't want euro bonds that serve to mutualize the entire debt of the countries in the euro zone. That can only work in the longer-term. I want euro bonds to be used to finance targeted investments in future-oriented growth projects. It isn't the same thing. Let's call them 'project bonds' instead of euro bonds.

We [European countries] probably need to move forward together, each at their own speed. The faster ones, that could be the countries in the euro zone. The others would be those who are interested in the continued development of the common market, but reject the idea of an ever stronger political integration.

We must continue to liberalise the single market, cut red tape and basically create a digital single market. We have not completed the single market yet, there is not sufficient free movement of goods, labour, services and money. We have to keep on working at that against all the protectionist tendencies that we have right now.