A Quote by Barry Gardiner

A Land Valuation Tax is a levy on the value of the land unimproved by buildings or other enhancement. The method is already used by insurance companies each year when they calculate your home insurance premium - they separate the cost of a total rebuild of the property from the value of the land itself.

Related Quotes

Our ideal society finds it essential to put a rent on land as a way of maximizing the total consumption available to the society. ...Pure land rent is in the nature of a 'surplus' which can be taxed heavily without distorting production incentives or efficiency. A land value tax can be called 'the useful tax on measured land surplus'.

Land taxes is the thing. They got so high that there is no chance to make anything. Not only land but all property tax. You see in the old days, why the only thing they knew how to tax was land, or a house. Well, that condition went along for quite awhile, so even today the whole country tries to run its revenue on taxes on land. They never ask if the land makes anything. "It's land ain't it? Well tax it then."

Assuming that a tax increase is necessary, it is clearly preferable to impose the additional cost on land by increasing the land tax, rather than to increase the wage tax - the two alternatives open to the City (of Pittsburgh). It is the use and occupancy of property that creates the need for the municipal services that appear as the largest item in the budget - fire and police protection, waste removal, and public works. The average increase in tax bills of city residents will be about twice as great with wage tax increase than with a land tax increase.

Economists are almost unanimous in conceding that the land tax has no adverse side effects. ...Landowners ought to look at both sides of the coin. Applying a tax to land values also means removing other taxes. This would so improve the efficiency of a city that land values would go up more than the increase in taxes on land.

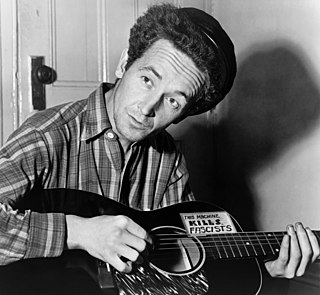

As I went walking I saw a sign there And on the sign it said "No Trespassing." But on the other side it didn't say nothing, That side was made for you and me. This land is your land, this land is my land From California to the New York island From the Redwood forest to the Gulf Stream waters This land was made for you and me.

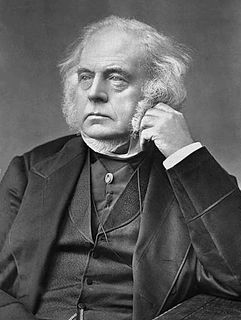

As to the Income Tax, my opinion is that the needful revenue would be fairly and most fairly raised if paid by property, and by individuals in proportion to their property. A Property Tax should be an assessment upon all land and buildings, and canals and railroads, but not on property such as machinery, stock in trade, etc. The aristocracy have squeezed all they can out of the mass of the consumers, and now they lay their daring hands on those not wholly impoverished.