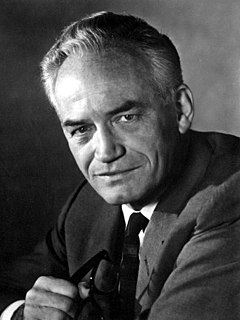

A Quote by Barry Goldwater

Where is the politician who has not promised to fight to the death for lower taxes- and who has not proceeded to vote for the very spending projects that make tax cuts impossible?

Related Quotes

You are smart people. You know that the tax cuts have not fueled record revenues. You know what it takes to establish causality. You know that the first order effect of cutting taxes is to lower tax revenues. We all agree that the ultimate reduction in tax revenues can be less than this first order effect, because lower tax rates encourage greater economic activity and thus expand the tax base. No thoughtful person believes that this possible offset more than compensated for the first effect for these tax cuts. Not a single one.

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

Look, I'm very much in favor of tax cuts, but not with borrowed money. And the problem that we've gotten into in recent years is spending programs with borrowed money, tax cuts with borrowed money, and at the end of the day that proves disastrous. And my view is I don't think we can play subtle policy here.

Corporate tax reform is nice in theory but tough in practice. It most likely requires lower tax rates and the closing of loopholes, which many companies are sure to fight. And whatever new, lower tax rate is determined, there will probably be another country willing to lower its rate further, creating a sad race to zero.

A federal bailout would spare California from having to make spending cuts needed to bring its budget into balance. The matter has become urgent since California voters rejected several tax-hiking ballot initiatives. Rather than taking the vote as a signal to dramatically curtail spending, the state turned to the feds. If they get a free pass, the politicians can avoid fixing any of their past mistakes or preparing California for the future.

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

People in my hometown voted for President Reagan - for many, like my grandpa, he was their first Republican - because he promised that tax cuts would bring higher wages and new jobs. It seemed he was right, so we voted for the next Republican promising tax cuts and job creation, George W. Bush. He wasn't right.