A Quote by Barry Ritholtz

People forget that although we can pinpoint the price, we can only guess at future earnings. The past isn't much help: It simply tells whether a market was pricey or cheap.

Related Quotes

In our view, though, investment students need only two well-taught courses-How to Value a Business, and How to Think about Market Prices. Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business who's earnings are virtually certain to be materially higher five, ten and twenty years from now.

The big picture is: the main thing you should be concerned about in the future are incremental returns on capital going forward. As it turns out, past history of a good return on capital is a good proxy for this but obviously not foolproof. I think this is an area where thoughtful analysis can add value to any simple ranking/screening strategy such as the magic formula. When doing in depth analysis of companies, I care very much about long term earnings power, not necessarily so much about the volatility of that earnings power but about my certainty of "normal" earnings power over time.

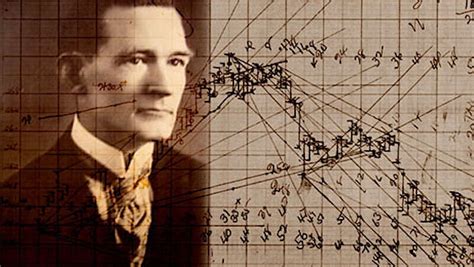

Time is the most important factor in determining market movements and by studying past price records you will be able to prove to yourself history does repeat and by knowing the past you can tell the future. There is a definite relation between price and time. By studying time cycles and time periods you will learn why market tops and bottoms are found at certain times, and why resistance levels are so strong at certain times, and prices hold around them. The most money is made when fast moves and extreme fluctuations occur at the end of major cycles.